At SmartCapitalMind, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

What is Mortgage Risk?

Lenders writing mortgages must consider the danger posed by borrowers who prove to be unwilling or unable to make the agreed mortgage payments. Financial professionals refer to potential borrower default as mortgage risk. Lending underwriters must assess the likelihood of both missed payments and complete abandonment of the loan.

Financial institutions use many tools to calculate the level of mortgage risk involved in each loan. The first tool used by lenders is a credit check. Most lenders check the credit scores of mortgage applicants by pulling their credit history reports. Credit reports enable lenders to evaluate the ability of a loan applicant to make timely loan payments. People who have a poor credit score pose a greater degree of mortgage risk and are often ineligible for loans.

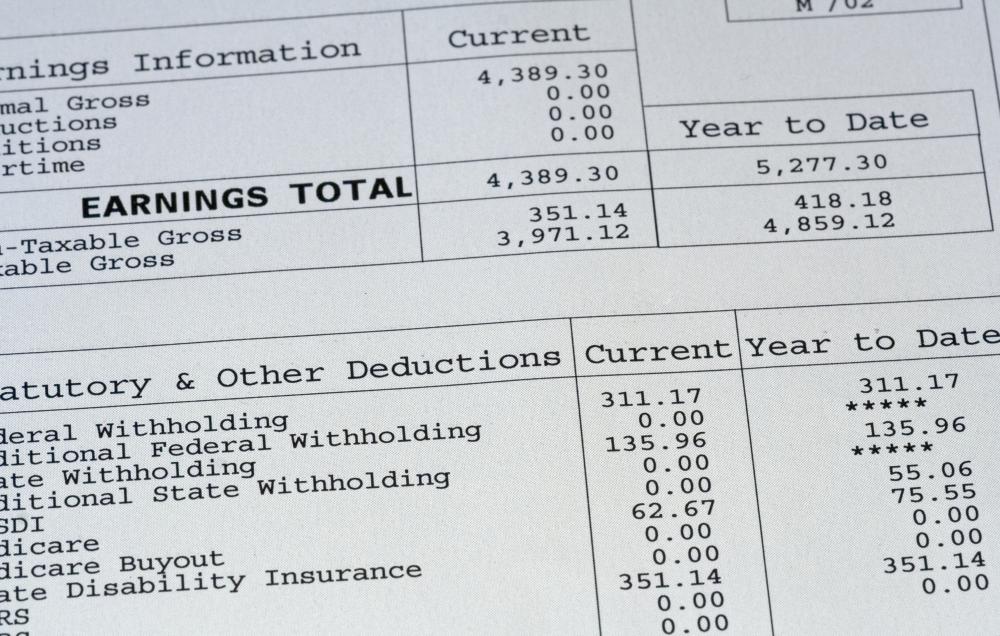

Loan originators gather documents including income statements, tax returns and recent pay stubs to verify the monthly income of loan applicants. Anyone with a high debt-to-income (DTI) ratio exposes the lender to a greater level of mortgage risk because a lack of surplus cash leaves the borrower ill-equipped to deal with unexpected expenses. To minimize mortgage risk, many mortgage issuers do not lend to individuals with DTI ratios above a certain percentage, such as 45 percent.

Home appraisals play an important role in establishing the risk level of a particular loan. A mortgage amount cannot exceed the value of the home used as collateral. To reduce the risk to the lender posed by depreciating home prices, most mortgagees limit loan-to-value (LTV) ratios, with 80 percent being a common limit. People with high credit scores, low DTI ratios and homes in desirable locations, might be able to establish mortgages with higher LTV ratios.

After establishing the level of mortgage risk posed by a particular loan, lenders must price the loan. To mitigate the risk of default, lenders charge higher closing costs and interest rates on loans that are taken out by high-risk borrowers. People who have excellent credit are rewarded with low rates and less-stringent underwriting guidelines.

Financial institutions share the inherent mortgage risks with other entities such as mortgage insurers and investors. Mortgage insurers charge monthly premiums for insuring the lender in the event of borrower default. Investment companies buy mortgages and divide them up into bonds that are sold to investors. People buying mortgage-backed bonds receive interest payments that are derived from the mortgagor's monthly payments. Investors are exposed to mortgage risk because if the borrower defaults, the mortgage bonds become worthless.

AS FEATURED ON:

AS FEATURED ON:

Discussion Comments

@Bhutan - I also heard a report about the no document loans that were occurring in the mortgage sector and I could not believe it!

To imagine there were literally people who could not pass the credit check to rent an apartment were allowed to be given a mortgage and therefore a house is hard to imagine, yet it was true.

There are some banks that did not take part in these lending practices, so if someone felt strongly about supporting banks that did not help in putting us in the Great Recession I would suggest doing so!

I talked to a city council member who has worked in the real estate business for decades and he said that there is always a backlash from rules being too lenient and then the regulations go to be too restrictive. The good news is they always find a way to get the restrictions back to a more fair middle ground.

Wouldn't it be nice if we could actually stay in the fair middle instead of bouncing from lenient to conservative and then back to middle ground? After the Great Recession, middle of the road is looking like some solid ground to stand on!

@BrickBack -I know what you mean. There were people that had multiple mortgages on a property that were completely underwater. I almost bought a short sale property in which the owner had a traditional 80% mortgage and a 20% second mortgage for the down payment.

Essentially the man did not put any money down and now he owes twice what the home was worth. He also had a mortgage on his primary home that he bought a few years prior to this one. Clearly he was overextended even if the property values would not have gone down.

He was trying to sell his property for $300,000 less than what he owed. Short sales are a problem because banks approved them half of the time because realtors set these prices on these homes in order to generate interests but usually the price is artificially low and after months of dealing with the bank the bank often comes back rejecting the offer.

This is what happened to me on a short sale property that I wanted to buy. I will stick with foreclosures in the future and stay away from short sales because they are a real headache.

@Icecream17 -I think that now that the mortgage standards are so much higher many people no longer qualify for a mortgage. Some of the problems involve the properties not appraising and sometimes the borrower does not have enough of a down payment or a high enough credit score for the bank to feel safe with the loan.

Sometimes if you are buying a condo for example, the banks will look at the number of owner occupants as well as the foreclosure rate in a building and the health of the home owner’s association.

I was preapproved for a loan, but my bank denied a loan on a condo that I wanted to purchase because the building had lower than a 50% owner occupancy rate, and the foreclosure rate at the time was 24% which exceeded the amount for them to extend the loan. Sometimes mortgage loans are not approved because of the property chosen and not because of the buyer.

@Bhutan - I agree but the problem also involves a lot of government loan programs that required banks to offer a certain percentage of loans for low income families. These programs allowed low income families that qualified to receive a mortgage with just a 3% down payment.

This was a program that originated in the 1970’s by Jimmy Carter that made homes affordable for everyone. It allowed low income families to share in the joy of owning a home. The problem is when you only put 3% down on a home you run a higher risk of foreclosure and you also have basically no equity in the home when you buy it.

Also, owning a home is not just about the mortgage, but you also have to consider the property taxes and homeowner’s insurance and if you put less than 20% down you will also face mortgage insurance which could really make a home out of reach.

You also have to add that Fannie Mae and Freddie Mac offered a guarantee on these risky loans and now they are both bankrupt.

I think that a lot of banks underestimated the mortgage crisis. At the height of the real estate boom they were giving loans to just about anybody. As a matter of fact, they even had these no doc loans which were essentially no documentation loans in which the borrower only had to state his or her income.

They did not have to prove it with their tax information or pay stubs. This was really crazy because you had people that only earned $40,000 a year having multiple mortgages on multiple properties.

I think that in this period of time everyone wanted to take advantage of the double digit real estate gains, but unfortunately that was short lived and now we have more foreclosures than we know what to do with. I think that this is why banks are going back to basics and offering mortgages to people that can truly afford the mortgages.

Post your comments