At SmartCapitalMind, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

What is Market Price?

In finance, the term market price, or market value, refers to the most recent price at which a security transaction took place, if it was completed on an exchange. If the transaction took place over the counter, with brokers and dealers negotiating directly with each other, the term refers to the most current bid, the price requested by the broker, and the most current ask, the price demanded by the dealer. As an economic concept, it is the price at which a good or service is offered at in the marketplace, which is reached when market supply and market demand meet.

Alfred Marshall, an influential English economist, developed the supply and demand model to explain how human behavior determined market price. Supply is the service or good that producers are willing to provide at a given price. Demand is the value of a service or good that purchasers are willing to buy at a given price. There is an inverse relationship between price and supply, and a direct relationship between price and demand.

On a typical supply and demand graph, the X-axis shows quantity and the Y-axis shows price. The supply curve slopes upward, while the demand curve slopes downwards. The point of intersection between the two curves is the market price, also known as the equilibrium point. Various factors can shift the supply or demand curve significantly, affecting the equilibrium price. For example, change in weather can affect the supply of certain goods while the change in consumer preference can greatly change demand.

This supply and demand theory regarding price, while popular, has been criticized as being too simplistic. It can be argued that a good or service may already have a price before reaching the marketplace. Moreover, buyers are not always considered by producers when creating a commodity.

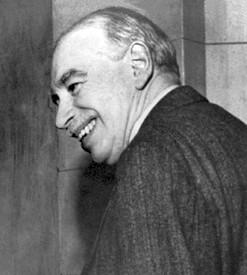

Another contradiction to Marshall's theory comes from Keynesian economics, named after the renowned economist John Keynes. He noted that prices could become "sticky" by not responding to fluctuations in either demand or supply. This is especially likely to occur when prices are decreasing. A noted example of such as situation is the Boston housing market in the 1990s, where buyers and sellers could not agree on a market price as the market dried up.

Other deterrents to the natural laws of supply and demand are monopoly and oligopoly. When there is only one or a limited number of providers of a certain commodity, it has the power to dictate the product's price. Similarly, in a monopsony, situations where there are many sellers and one buyer, the buyer is able to dictate the price.

AS FEATURED ON:

AS FEATURED ON:

Discussion Comments

Mutsy- I wanted to say that the same relationship can be found between the stock market and the stock market price of a particular stock.

If there is generally positive information regarding a company more people will be prone to buy that stock.

This drives the market price stock up which makes it more expensive to purchase because of the reduced shares in circulation.

The flip side is also true. If there is adverse information regarding the company, many stockholders of that company's stock may choose to sell the stock causing the price of the stock to decrease.

For example if a company is rumored to have financial problems and considering bankruptcy the stock price of that company will shortly plummet.

The home market price is a perfect example of this economic theory of supply and demand. After the real estate market bubble burst, there was an over abundance of homes on the market.

There was more than a two-year supply of inventory of homes, in most markets when the optimum inventory levels should be closer to six months. The housing market price dropped significantly because there was so much stock available.

Post your comments