At SmartCapitalMind, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

What is an Interest Rate?

Those in the money lending business have the legal right to charge borrowers an additional fee for their services. For instance, if Jim borrows $100 US Dollars (USD) from Jeff, that money would be considered the "principal" amount of the loan. Jeff can ask Jim to pay back the principal plus $10 USD, which would be considered an "interest" payment. By dividing the $10 USD interest amount by the $100 USD principal amount, the result is a percentage called the interest rate. In this case, 10 divided by 100 yields an interest rate of 10%.

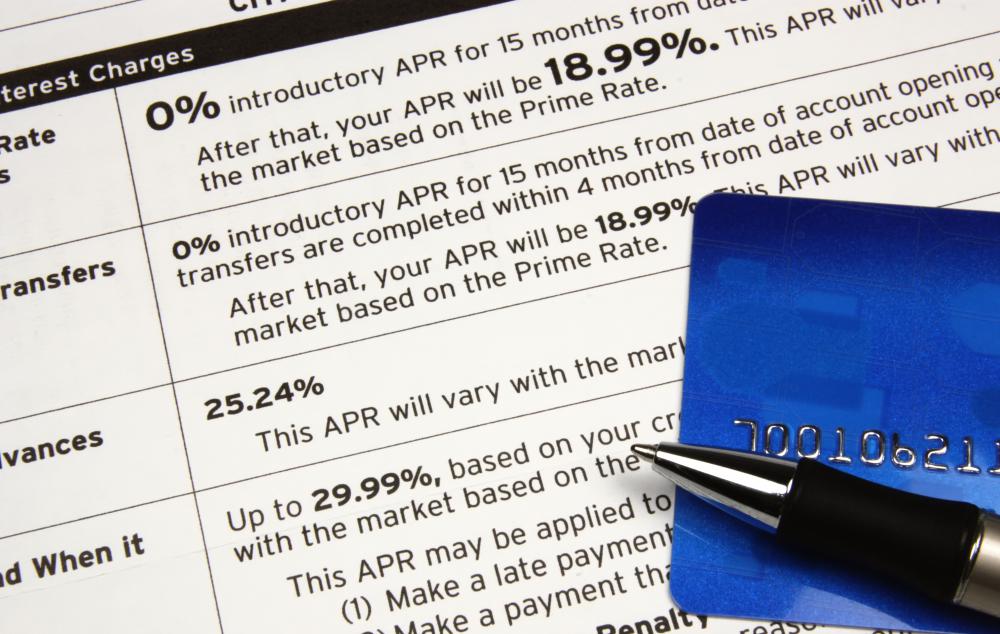

The interest rate of a loan is usually calculated as an annual figure, even if the terms of the loan call for a different repayment schedule. Loans for vehicles are often advertised as having a 2.9% Annual Percentage Rate (APR), even if the actual payments are spread out over 5 years. This rate indicates that, for every $1,000 USD loaned for the price of the car, the lender will receive an additional $29 USD in interest payments. This amount is added to the borrower's monthly installment payments.

An interest rate expressed as an annual percentage can help determine if a particular lender's terms are reasonable. Payday advance lenders, for example, can charge a flat fee for a short-term loan due upon receipt of the borrower's next paycheck. Expressed as a surcharge, this interest payment may not appear excessive; perhaps a $50 USD interest payment on a $250 USD emergency loan. But calculated as an annual interest rate, the result is a relatively high 20% APR. Some short-term loans have an annual rate of 150% or more if the loan is not repaid in full and the interest accrues daily or monthly.

Loans can have an interest rate that is "flexible" or "fixed." A fixed rate means that the lender can only charge the same amount of interest per month throughout the life of the loan. Many borrowers prefer to find a lender who offers a fixed interest rate because the repayment terms are predictable and protected by a contract. Because the rate cannot be adjusted, however, many lenders charge more for the loans or don't offer them in the first place. When buying a large ticket item such as a home, a fixed interest rate is almost always preferable to a flexible one.

In the case of a flexible interest rate, lenders often tie the loan's interest to the current federal lending rates, also known as the prime lending rate. This is the rate charged by the federal government to major banks and other lending institutions. The prime lending rate is regularly adjusted by the Federal Reserve Board chairman, based on economic factors such as inflation or high unemployment. Lenders can legally charge borrowers an interest rate that is a few points above the prime lending rate at the time of the initial loan. If the rate changes, the interest on the loan can also be adjusted. A flexible rate can be beneficial when the economy is healthy, but can be more costly if the rates are raised suddenly.

Consumers should understand how an interest rate is calculated before applying for store credit cards and other charge accounts. Credit card companies routinely promote lower introductory rates to attract new customers, but the standard rate on many cards is 21% or higher.

AS FEATURED ON:

AS FEATURED ON:

Discussion Comments

Interest is the root cause of the financial crisis. Money just evaporates. Think about it.

What types of credit cards have interest rates?

what is the current interest rate that an individual would earn if they opened a savings account?

I own a home and it is rented in another state for the next 2 years. How do I buy another home?

i was wondering, what options are available to me that i can do to increase my interest rate for saving or MMA?

Post your comments