At WiseGEEK, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

What is an Interchange Rate?

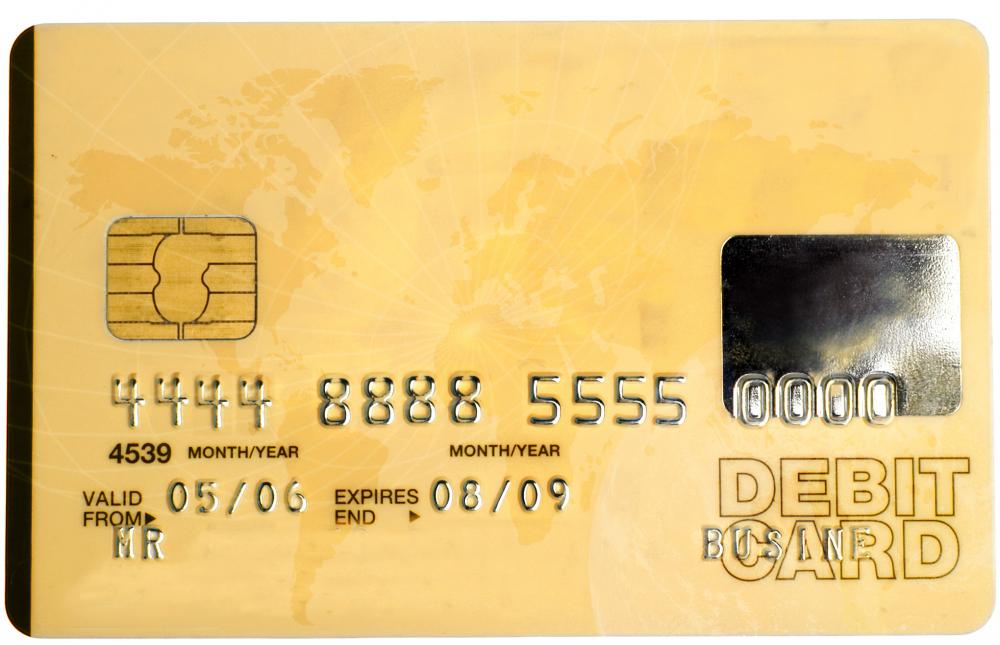

An interchange rate, or interchange fee, is a per-transaction fee assessed each time a credit, debit or ATM transaction occurs. In an ATM transaction, the bank that issued the card must pay the fee to the merchant or bank who owns the ATM to help alleviate the cost of operating the machine. In a credit or debit transaction, the merchant from whom the purchase is made must pay the fee to the bank that issued the card to cover the costs of converting the electronic transaction into hard cash.

There are three main parties concerned with interchange rates. The bank that owns, or represents the merchant who owns, the ATM or credit card processing machine is called the "acquirer." The bank that issues the card is, of course, referred to as the "issuer." The third party is the "network."

When a card is swiped at a credit card machine or ATM, the transaction is run through an electronic network. Networks are important for two reasons: they set the interchange rate, and they are responsible for collecting fees from and distributing fee moneys to the correct parties for each transaction. Each credit card brand operates at least one electronic network. Many major credit card brands own several networks that operate in different parts of the world and, sometimes, in different parts of the same country.

In debit and credit transactions, the interchange rate is expressed as a percentage of the total purchase amount. ATM transactions use a set fee system for each type of transaction. Balance checks and transfers, for example, usually have a lower fee than withdrawals.

Interchange rates are critical both to banks choosing a brand for their credit and debit cards and to merchants deciding which cards to accept in their stores. A bank will generally want to issue credit and debit cards branded by the company that sets the highest fees in order to make more money. Merchants, however, may decide not to accept brands that charge considerably higher fees than other brands in order to save money.

Most debit cards can be run either as a debit or as a credit, but the interchange rate for credit transactions is usually significantly higher than the rate for debit transactions. This is why many merchants have credit card machines that prompt consumers to choose a debit transaction. It is also why many banks have begun offering reward programs for consumers who choose credit transactions.

In theory, an interchange rate is transparent to the customer using the card. In reality, however, these fees often do affect consumers. For example, merchants may raise overall prices, set a minimum purchase for credit transactions or choose not to accept certain cards at all.

AS FEATURED ON:

AS FEATURED ON:

Discuss this Article

Post your comments