At PracticalAdultInsights, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

What Does a Payroll Coordinator Do?

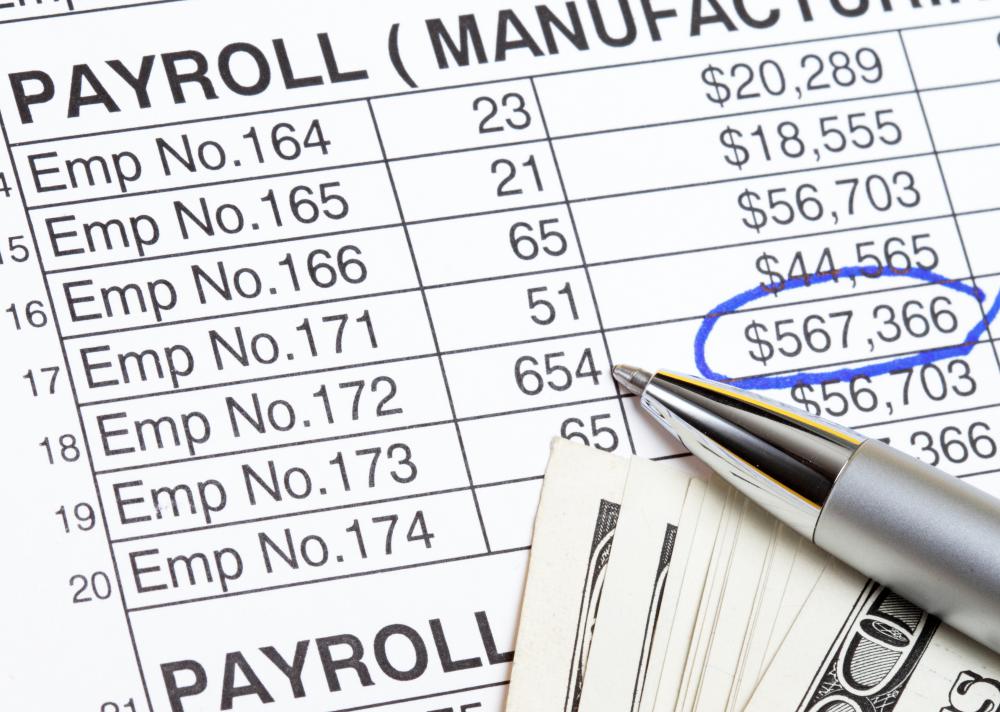

A payroll coordinator manages the system for compensating employees and paying employment taxes. This includes processing time worked for ordinary pay, but can also include managing reimbursements, calculating benefits owed, and processing bonuses and other one-time checks. The actual scope of a coordinator's job depends on the organizational structure of the company. Large companies with diversified accounting departments will typically assign a payroll coordinator strictly processing duties. Small companies without dedicated accounting or human resources staff will likely expect a coordinator to do everything required to pay employees and keep track of benefits.

One of the most complicated parts of business operations is payroll processing. The task is highly regulated from a number of directions. Employers are required by law to pay employees according to a schedule, in an agreed upon amount, and to properly compensate for overtime worked. Companies are also required by law to pay appropriate employment taxes to local and regional governments. Furthermore, tax authorities require companies to keep proof of time worked by employees in case business expenses are audited by the government.

These potential legal liabilities make payroll management a critical business function. A payroll coordinator is a specialist that is hired specifically to manage the process of paying employees according to an established schedule. This includes collecting, reviewing, and archiving time sheets, checking for accuracy in the time reporting process, and ensuring the proper authorizations are in place for the payment of regular pay and any overtime. Ultimately, the coordinator is responsible for packaging payment and delivering it to the employees. Cutting checks and arranging for electronic deposits into employee bank accounts are the typical ways payroll is finalized.

While a company is small with a limited number of employees, a payroll coordinator can often manage the payroll process by hand. Time computations are kept in a financial spreadsheet, checks are executed in-house, and tax payments are made through a direct business account with the tax agency. As soon as a business reaches a certain capacity, however, it becomes impossible to manage payroll this way. A payroll coordinator at the next level is responsible for running some type of payroll software or working with a payroll processing company. The tasks are basically the same except the entire system is computerized.

As the workforce increases in number, payroll management needs also expand. Depending upon the operational structure of the company, a payroll coordinator can be expected to keep an accounting of benefits owed to employees, such as accumulated contributions to a retirement plan. He can be tasked with tracking and executing expenses reimbursement and handling questions from employees about their rate of pay and other issues. A coordinator will work with accounting and human resources personnel to fulfill these ancillary tasks, or sometimes operate in lieu of dedicated staff in these departments, depending upon the circumstances.

AS FEATURED ON:

AS FEATURED ON:

Discuss this Article

Post your comments