At WiseGEEK, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

What are the Pros and Cons of Having a Credit Card?

A credit card can be a useful item to have, but it can also be destructive to your life if you are not careful. Owning this little piece of plastic has its pros as well as its cons. How it is used can determine whether or not your financial standing is excellent or whether it less than pristine.

A benefit to having a credit card is that you can have it on hand in case an emergency arises. As beneficial as it is can be, you must be able to distinguish between a real and a fake emergency. For example, using it to pay for an immediate surgery that your insurance does not fully cover is an emergency; a new purse is not.

Another benefit to having a credit card is that it can help build your credit score. There is a catch, however, because simply having the credit card is not enough. In order for your credit card to work in your favor, you have to make payments on time. How much debt you have accumulated counts as well, so avoid carrying a balance. If used the correct way, your credit card can be a useful tool in helping you obtain a good credit score.

While many people use their credit card responsibly, there are those that are enthralled with instant gratification and purchase items that they cannot afford to buy. Some buy thousands of dollars of products, then get the bill and become overwhelmed because they cannot afford to pay it. Instead of paying off the balance each month, they pay the bare minimum. Even though they make their payments on time, the interest accumulates which forces the balance to increase. Before they know it, they are in over their heads with credit card debt and it becomes a serious problem. Unfortunately, this is a common disadvantage of having a credit card.

An obvious downside to having a credit card is that you put yourself at risk for identity theft. When you buy online or from a store, you are putting your faith in the security measures of the company and the individual employees. All you can do is hope that your information will not end up in the wrong hands. Make sure to shred any personal paperwork that has credit card numbers on it and read your statements carefully. Also, be aware of any companies that you have purchased through that have had security issues, for example, an employee that stole customer’s personal information. In addition, check your credit report once a year without fail.

While having a credit card has both its pros and cons, it is up to you to use it wisely. Contrary to the thoughts of some, owning one is a big responsibility. When used correctly, a credit card can be a quite beneficial item to have in your wallet.

AS FEATURED ON:

AS FEATURED ON:

Discussion Comments

Crispety-I think that credit cards for bad credit are the secured credit card with a prepaid balance.

These credit cards offer a small credit limit but have to be secured with a bank account so that the bank has a guarantee that the card holder will pay the balance on the card.

They usually have to deposit the exact amount that they have in terms of a credit limit in a bank account that is frozen and is used as collateral for making payments on the card.

This is an ideal way for someone with bad credit to reestablish their credit or for someone that is establishing their credit for the first time and receiving a first credit card.

These types of credit cards are best for people that overspend because the way that these cards are set up you will not be able to do that anymore.

Bhutan-I think that many people use credit cards to get the rewards points. I think that if you consistently pay off your credit card balance at the end of the month this could be a nice little bonus.

I know that BP offers 5% back on all gasoline purchases and 2% back on restaurant and food purchases.

They actually send you a check at the end of every quarter. So if you use the card for everything and pay the bill at the end of the month you will get a large rebate at the end of the quarter which is really nice.

I will say that if you are a person that carries a balance and does not pay off the bill at the end of the month, then I would stay away from rewards cards and go with a card like the Chase Slate card that offers a lower interest rate especially on balance transfers.

Rewards credit cards offer a higher interest rate which is how they can afford all of the gifts that they offer you. In addition, many have high annual fees. For example, the Chase Sapphire card offers a slew of travel rewards but also carries an $85 annual fee and the interest rates can go as high as 24%.

Icecream17-I agree. I think that the problem is that many people receive the credit offers and can’t resist.

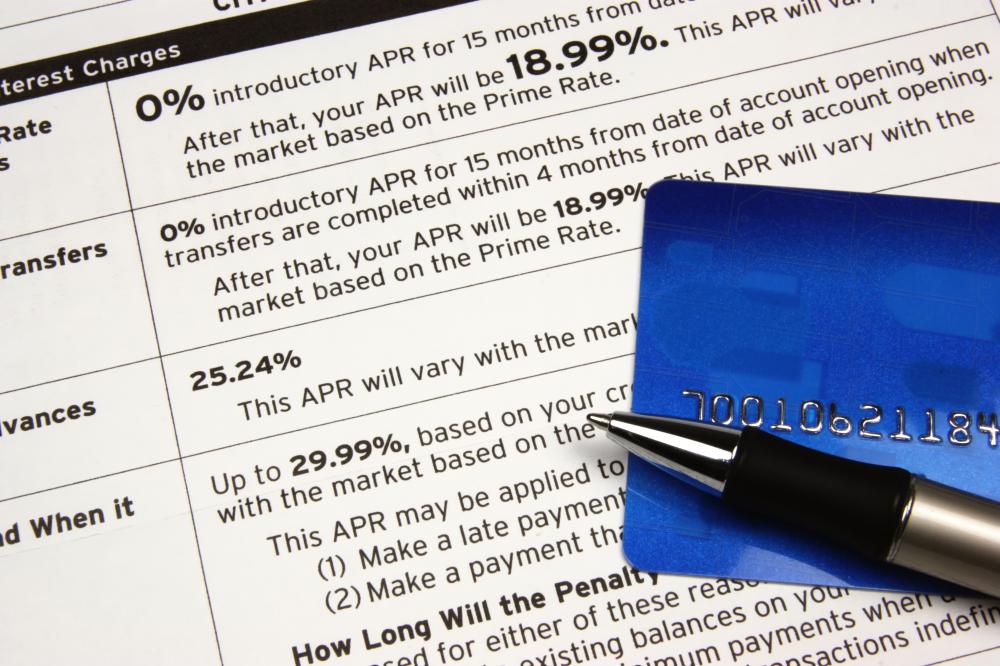

They see that they are offered an initial 0% interest on balance transfers and decide to take the plunge on the new card. What they don’t realize is that this introductory rate is only good for a period of about 6 months and then the interest rates shoot up to 14% to 24% interest based on your credit score.

If you carry a balance this type of card can actually be a bad credit card deal because with the high interest rates, it may take a lifetime to pay off a sizable balance.

I read somewhere that the average American is carrying about $10,000 in credit card debt. Because we live in a consumer driven society the debt that American’s carry will certainly exceed $10,000 in years to come.

The best thing to do with respect to credit cards is to simply pay them off at the end of the month and not carry over a balance.

Unsecured credit or having a credit card is really a double edged sword. On the one hand, having a credit card in case of an emergency can be a life saver.

If you have an unexpected expense like a mechanical problem with your car or in need of buying new tires, the credit card can help you with these repairs and purchases now.

You can even make small monthly payments instead of having to pay the full amount at once. While this is the ideal way to use credit cards, most people abuse their credit cards and as a result need credit card help because they have reached their card limit.

It is a proven fact that people spend about three times more when making a purchase on a credit card then when paying cash. The reason is simple. When you have cash you have a finite amount to spend, with a credit card the amount that is available can be several thousands to tens of thousands to reach your limit.

Most people only carry around a few hundred dollars not $25,000 in cash.

Post your comments