At WiseGEEK, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

How does a Deed of Trust Work?

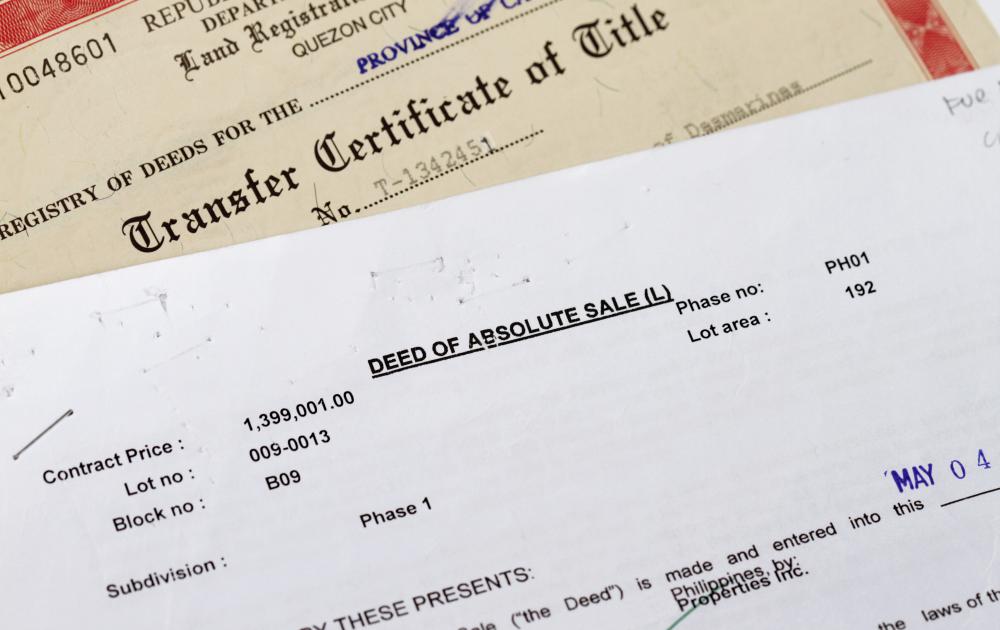

A deed of trust is a document similar to a mortgage that secures a loan for a potential home buyer, with the home acting as collateral. These agreements, which include a third party that oversees the loan, are used in certain states in the United States and can be bought and sold by lenders. The lender that holds the deed of trust can place a lien on the home if the borrower defaults on the repayment of the principal or the interest due. In such cases, the lender then has the right to take possession of the house from the borrower and even sell it.

When most people decide to buy a home, they do so lacking the capital to immediately buy the home for its asking price. To rectify this problem, they secure a loan that fronts them the money to make the purchase while promising to pay back the loan over a specified period of time. The most common way to achieve this is a mortgage, but a deed of trust is often used in some US states along with a standard loan agreement. It is essentially the document which spells out the terms of the agreement.

This process differs from a typical mortgage agreement in that it includes a third party that oversees it. In a typical deed of trust, the borrower is listed as the trustor, which is the person granting the repayment of the loan. The lender is listed as the beneficiary, since they are to receive the payment from the borrower. Finally, there is also a third party, known as the trustee, which essentially administers the agreement between the two parties.

In most cases, the trustee will be a title company, and this company has the power to transfer the title to the lender should the borrower default on the payments. At that point, the trustee can arrange for the sale of the property without any intervening court procedure. The borrower usually is allowed a period of time, once given official notice of the default, to catch up on the payments.

Otherwise, the lender essentially holds the deed and can claim the property as a result of the deed of trust. Lenders keep interest rates low by selling these deeds of trust to other lenders. This process is known as an assignment of a deed of trust. The transaction takes place entirely between lenders and may occur several times during the length of the loan, although it has no bearing on how much the borrower owes or the time that he or she has to pay the loan back, as those terms remain unchanged.

AS FEATURED ON:

AS FEATURED ON:

Discuss this Article

Post your comments