At SmartCapitalMind, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

How do I Choose the Best Credit Card Debt Consolidation Company?

Choosing the right credit card debt consolidation company can be a confusing process. By the time many people realize that they are in financial trouble due to their credit cards, they may have already received demand letters and phone calls from creditors. Along with this, will be endless offers of debt consolidation. Choosing a legitimate credit card debt consolidation company that will help end the cycle of credit card misuse can be the first step in regaining financial control.

Legitimate credit card debt consolidation companies will typically offer customers a free consultation to discuss their problems. During this meeting, it is important to find out as much information about the company as possible. If there are any concerns about the legitimacy of the company, they should be addressed before you hand over sensitive financial data.

A credit card debt consolidation company that offers credit counseling is a good choice. Credit counseling is the best way to avoid future struggles with credit. Many people believe they know exactly what mistakes they have made in the past, and will not make them again, but history shows that this is not typically how it works. Once the debt is paid, people often revert to their prior methods of spending, and accumulate debt again.

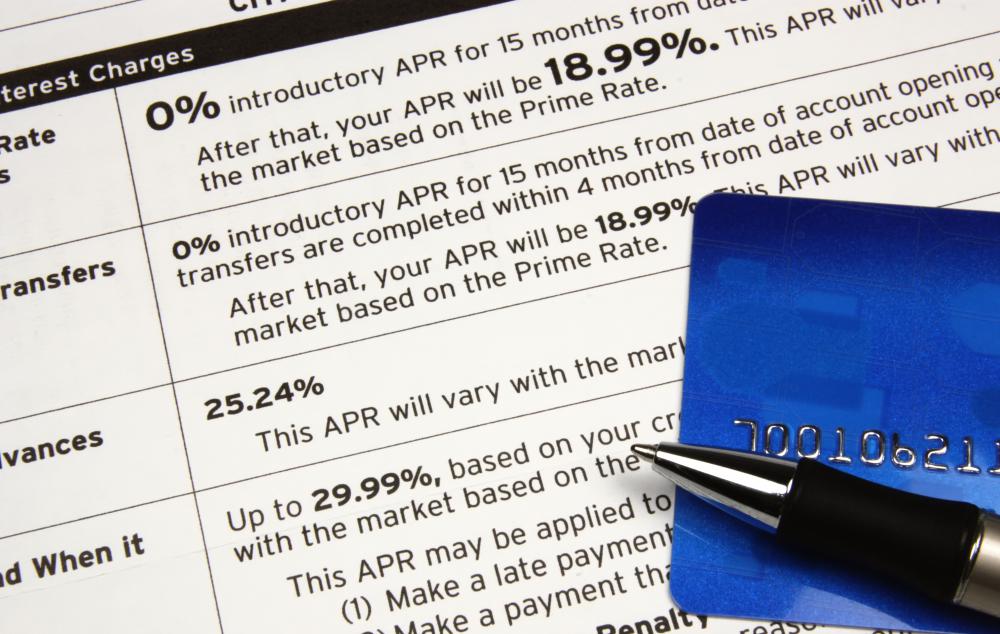

While counseling is important, it is not the credit card debt consolidation company's main job. The company collects a set monthly amount from the customer, and then distributes it to various lenders. They work with the creditors to lower interest rates and stop late charges so the amount of debt does not continue to climb. The client is not permitted to use credit during this period.

Once you have located several credit card debt consolidation companies, it is important to choose the one that is the best fit with your lifestyle. Ask about payment arrangements. There is typically a small monthly charge for the services of the debt consolidation company. Some companies charge a flat rate, while others charge according to the number of accounts that are being consolidated.

Credit card debt consolidation companies also receive financial support from the Fair Share and Grant Program. This is a voluntary program that credit card companies contribute to. This alternative source of funding means that the credit card debt consolidation companies have some leeway in the fees they charge their clients. They will often waive their fee for students, the elderly, and either current or former military personnel. It takes an average of four to five years to pay off credit card debt using a credit card debt consolidation company, so it is important to make your selection wisely.

AS FEATURED ON:

AS FEATURED ON:

Discussion Comments

Good information. I decided to get credit card counseling from Debt Guru and I'm so happy I did. Good luck.

Post your comments