At WiseGEEK, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

Which Documents Need to be Brought to a Tax Preparer?

Using a professional tax preparer can be an excellent idea, especially if there isn’t a lot of time to keep abreast of the latest information on tax deductions. When preparing to make your first visit to a tax preparation service, there are a number of documents that should be collected and taken to that first interview. Here are the most important documents that will need to be brought to a tax preparer, in order to get the process rolling.

First, take along personal identification. While this may seem like an obvious document that would need to be brought to a tax preparer, it is amazing how many people forget to do this. Bring your Social Security card, a valid driver’s license, or a government issued picture identification card. If you have dependents, also take along the Social Security numbers for each dependent. Tax preparers often like to make photocopies of these documents, and keep the copies in your client folder.

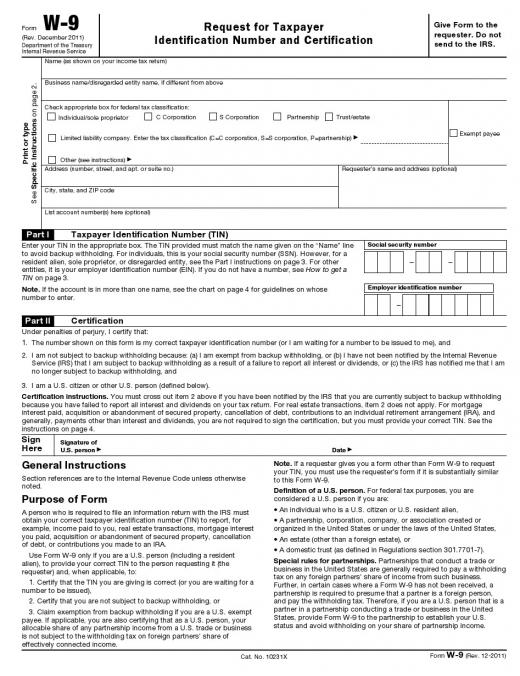

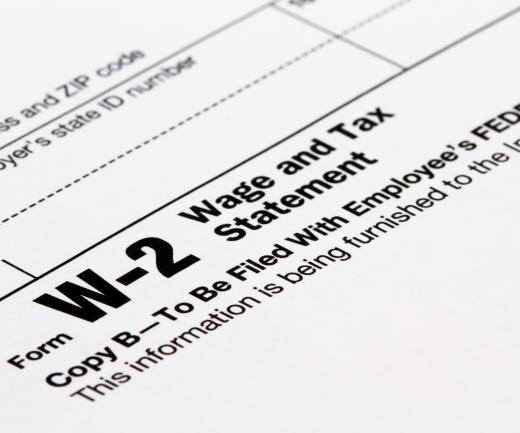

The task of doing taxes will require any forms that document your earnings from the previous tax year. There are several different types of income verification forms that should be brought to a tax preparer. For people who are employed by a company, your earnings will be recorded on a W-2 form. Independent contractors, including freelance professionals, will receive a 1099 form that will show all payments for services rendered. Should you have earnings from interest and dividends on investments, or funds accrued through the sale of assets, chances are you will also have a 1099-INT, 1099-DIV or a 1099 miscellaneous form to take along as well.

Many people are not aware that Social Security benefits may be subject to taxes. All benefits of this type are recorded on a SSA-1099 and should be brought to a tax preparer along with other documents. Even if you do not think that your total benefits will amount to enough to require a tax payment, take the information to the preparer anyway. Under the right conditions, you may find yourself eligible for a larger refund.

Tax documents from past years are also important. Copies of the previous year’s tax returns should be brought to a tax preparer, along with any documents that show the amount of federal income tax paid in previous periods. This helps to give the preparer an idea of what was done in the past, and can help him or her provide you with some practical suggestions on how to proceed with the current round of filing.

There are several other types of documents that should be brought to a preparer. Parents should present the name and employer identification number of the childcare provider, along with documents that verify the amount of payments made to the provider. If unemployment compensation was collected during the period, take along the statements.

Last, don’t forget to provide receipts for medical expenses, charitable contributions, and mortgage interest and payments. When brought to a tax preparer, all these documents can be considered and possibly utilized to justify a deduction to the amount of income taxes owed for the tax year.

AS FEATURED ON:

AS FEATURED ON:

Discussion Comments

Tax preparers are required to keep a copy of a government issued photo ID and social security or Medicare card. This ensures accuracy of submission, and helps minimize the possibility of identity theft.

I worked for a contractor in 2010. The company dissolved due to the economy. I am unable to get a 1099. What should I do? Thanks.

Post your comments