At WiseGEEK, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

What is Net Pay?

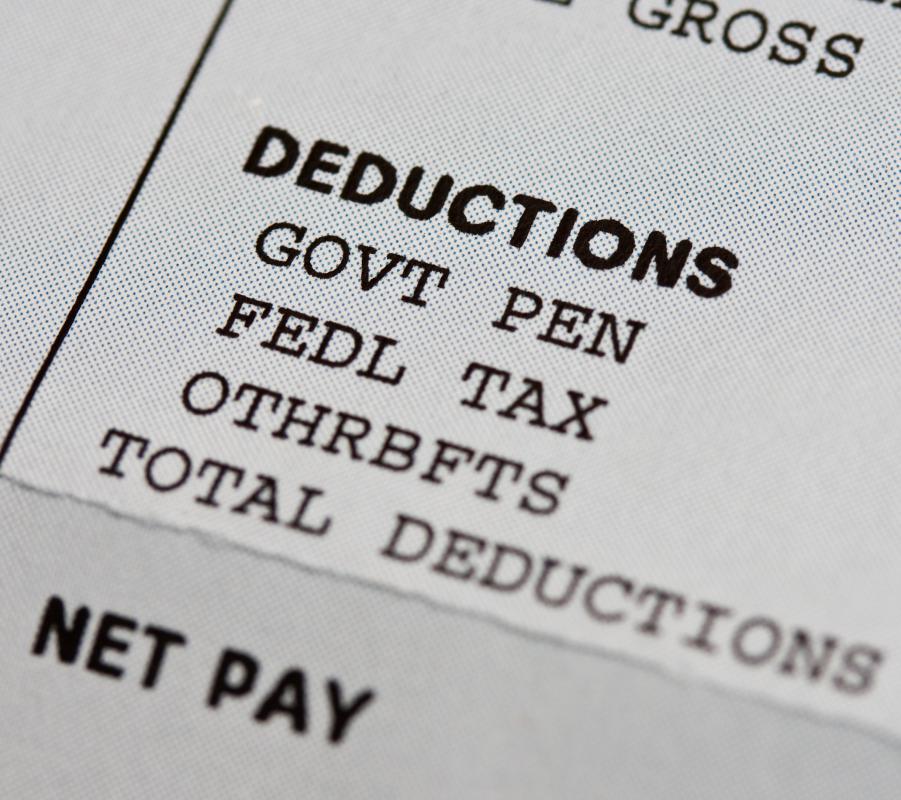

Net pay is the amount of money which someone actually takes home after all of the deductions, voluntary contributions, and so forth are taken out of his or her gross pay, the amount the employee earned. The difference between net and gross pay can sometimes be very significant, and it is an important consideration in budget management. When employees receive a paycheck, they also receive an earnings statement which shows how the employer arrived at the total amount of net pay.

One of the most significant deductions from gross pay tends to be taxes. Employees may need to pay taxes in several jurisdictions, as for example in the case of a California resident who pays both Federal and State taxes. In addition, deductions for Social Security to cover disability and retirement are common in the United States. These amounts are fixed by the government, and they are usually based on a percentage of income.

Something for employees to be aware of is that when employers deduct money by order from the government, they are obligated to turn that money over to the government in a timely fashion, and if they fail to do so, employees may be entitled to compensation. In the case of taxes, for example, an employer must pay quarterly taxes, submitting the amount he or she deducted from employee paychecks to the government. If employees suspect that quarterly taxes are not being paid, or that an employer is withholding too much, they should report this to the government agency which processes taxes.

Voluntary contributions which can reduce net pay can include things like union dues, payments into retirement accounts, and payments into employee healthcare plans. In these cases, the employer subtracts these contributions from the employee's gross earnings and submits them to the appropriate agency or office. Often, employees are promised matching contributions from their employer as an incentive to save for retirement or buy into a healthcare plan, and the employee may be able to get a better rate by submitting to deductions.

Another factor which can have an impact on net pay is garnishing. Wage garnishing is a technique used to recover funds from someone who is not paying them. It may be utilized by tax authorities to collect unpaid taxes, or by former partners to collect promised alimony, for example. Any situation in which a monetary judgment is handed down and not complied with can result in garnishment. In order for an employer to garnish someone's wages, he or she must be given a legal order to do so, and the amount of the garnishment must be shown on the earnings statement.

Numerous calculators to help people determine their net pay can be found across the Internet, and it can be useful to think about take home pay when making salary and wage negotiations.

AS FEATURED ON:

AS FEATURED ON:

Discussion Comments

@MrMoody - One of the things that I do to significantly reduce my tax burden is to give to charity as well as to a healthcare savings account. There are limits on how much you can give (and deduct) per I.R.S. regulations, but I haven’t hit that limit yet. I use tax software to calculate net pay after deductions.

One of the first things that I do after I get my paycheck is to glance down at two figures—the gross pay first, then the net pay. I think it should go without saying that I prefer the gross pay number better.

I’m glad that the employer performs the net pay calculation so I don’t have to know in advance how much tax to withhold, but the reality is that without taxes I could probably get by on a smaller gross pay. Most years, however, I get a decent tax refund so I have nothing to complain about. It would just be nice to have all the money upfront.

Post your comments