At SmartCapitalMind, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

What is an Automatic Withdrawal?

There are two primary definitions of an automatic withdrawal. The first is an arrangement within a mutual funds program, in which the investor, or shareholder, chooses to receive fixed monthly or quarterly payments, which come from the dividends of his or her investments. The second type of automatic withdrawal is the automatic transference of money from one account to another; i.e. from one's checking account to a company in payment of a bill, or from one's checking account into one's savings account. This second definition is the topic of this article.

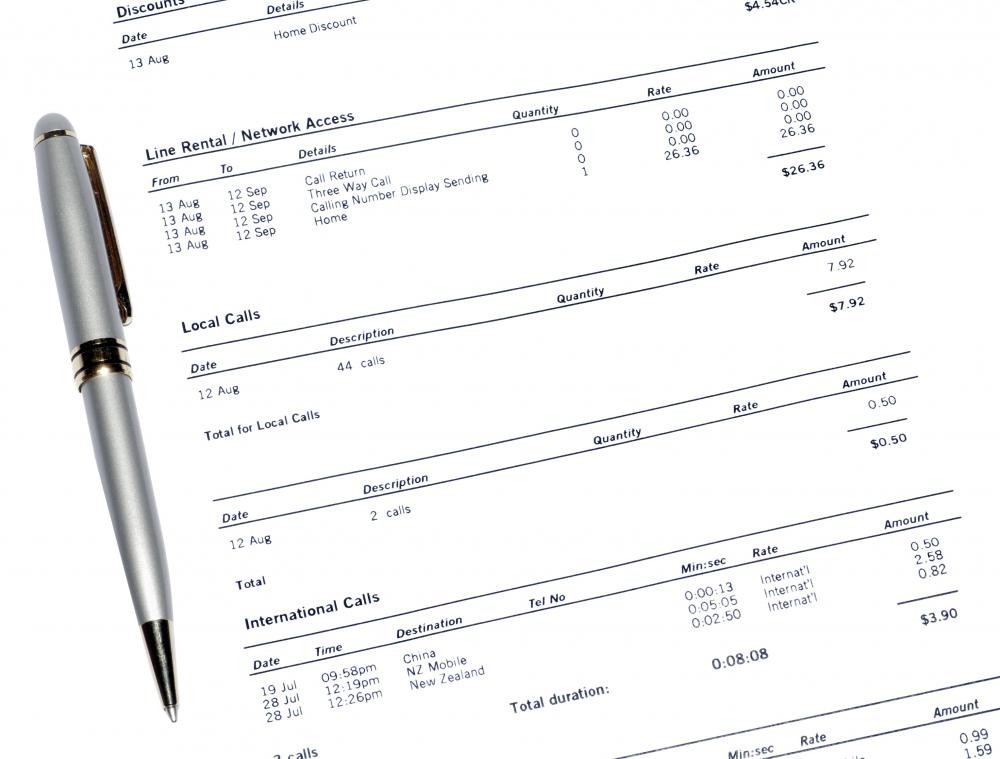

One of the most common uses of an automatic withdrawal is to set up an automatic monthly bill payment. The customer authorizes the company to access his or her bank account and withdraw funds, which may take place once a month or biweekly, for the purpose of paying a bill. The amount of the withdrawal may be a fixed amount, such as with a mortgage or car payment, or it may vary from month to month, such as a phone bill or electricity bill.

When setting up an automatic bill payment with a company, it is especially important to remember that even if the company makes a mistake one month, and charges too much on a bill, that amount will still be automatically withdrawn. The downside to this is that it is necessary to have a certain amount of buffer in the checking account, should a mistake occur. This will prevent any overdraft fees. Keep in mind that user error is also possible, and it is the responsibility of the account holder to make sure there is enough money in an account to cover withdrawals.

Another way to use automatic withdrawal is with a savings account. One might choose to have a certain amount taken out of a checking account on a certain day every month, or even after every paycheck, and deposited into a savings account. Some people find it much easier to save money this way, when it is an automatic process. Automatic withdrawals and deposits can also be useful for retirement and investment accounts. Most banks allow users to set up automatic transfers between accounts on any schedule they choose.

To set up automatic withdrawal for bill payments, it is generally possible to simply authorize a company directly to take the money every month by signing a release form. When setting up automatic transfers between accounts, it will likely be necessary to visit the bank in person. Using automatic withdrawals can save time by eliminating the time spent writing checks or mailing bills, but be sure to keep careful track of the amount being withdrawn, and any fees that are assessed to avoid losing money or overpaying.

AS FEATURED ON:

AS FEATURED ON:

Discussion Comments

Can automatic withdrawals happen on the weekend? Or just during business days?

Post your comments