At WiseGEEK, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

What is an Account Freeze?

Sometimes referred to as an account hold, an account freeze is a situation in which the assets contained in a bank or brokerage account are no longer available to the account holder, even though those assets are still held within the account. In addition, any transactions pending on the account at the time it is locked or frozen cannot be processed. There are a number of reasons why an account may be frozen, including the suspicion of illegal activities, liens filed against the account, or the death of the account holder.

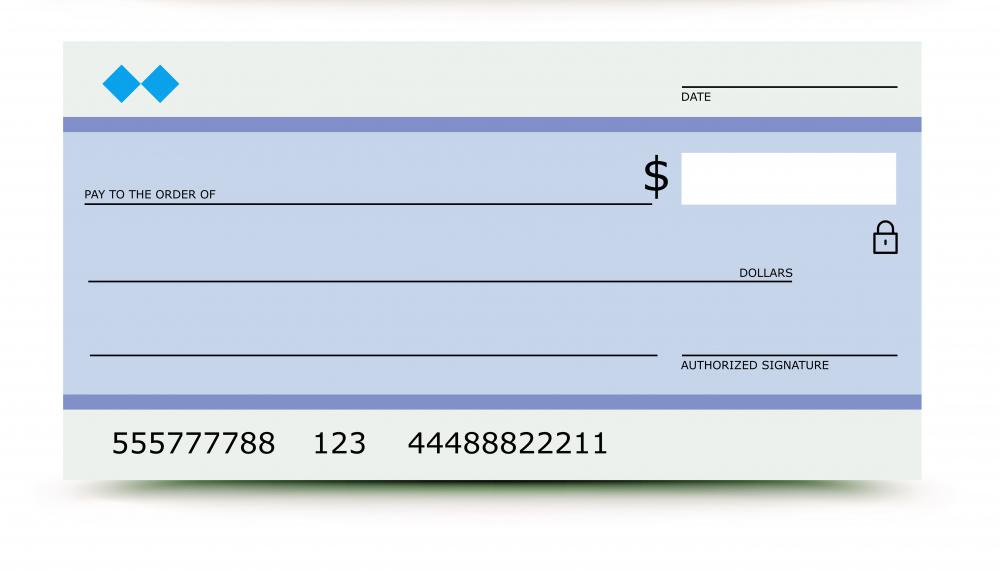

There are situations in which the account holder will initiate the request for an account freeze. For example, if the blank checks associated with a checking account are lost or stolen, the account holder may contact the bank and ask that no further transactions be processed on that account. In this scenario, the bank will immediately close the account to any further transactions, and take steps to open a new account for the client. The funds in the frozen account are transferred into the new account, allowing the customer to have access to those funds once again. The frozen account is eventually closed altogether, usually within six months after the freeze is implemented.

In situations where two or more people have access to an account, actions may be taken to prevent any authorized party to draw on the account balances while some type of legal dispute is taking place. The most common example is a couple that is or about to go through divorce proceedings. Legal counsel for one or both parties may obtain permission to initiate an account freeze while the joint assets of the couple are assessed. Once the separation of property and assets is determined and approved, any frozen checking, brokerage, or savings account can be released, and the proceeds divided between the former spouses in accordance with the terms of the divorce decree.

Government entities can also initiate an account freeze. Often, this is done as an attempt to settle outstanding balances due on tax accounts. The action may also be due to suspicion by legal authorities of some type of criminal activity on the part of the account holder. Once the tax debt is satisfied, or the account holder is cleared of any wrongdoing by a court of law, the account freeze is reversed. At that point, the account holder has access to any funds that are within the account as of the day of the release.

AS FEATURED ON:

AS FEATURED ON:

Discuss this Article

Post your comments