At WiseGEEK, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

What is a Bank Reconciliation?

Just about everyone engages in some form of bank reconciliation. From households to big business, bank reconciliation is a part of sound financial management. Essentially, bank reconciliation is the act of taking documentation issued by the bank and comparing it to documents that are generated by the account holder, and making sure the two sets are in harmony with one another. Here are some tips on how to deal with bank reconciliations quickly and effectively.

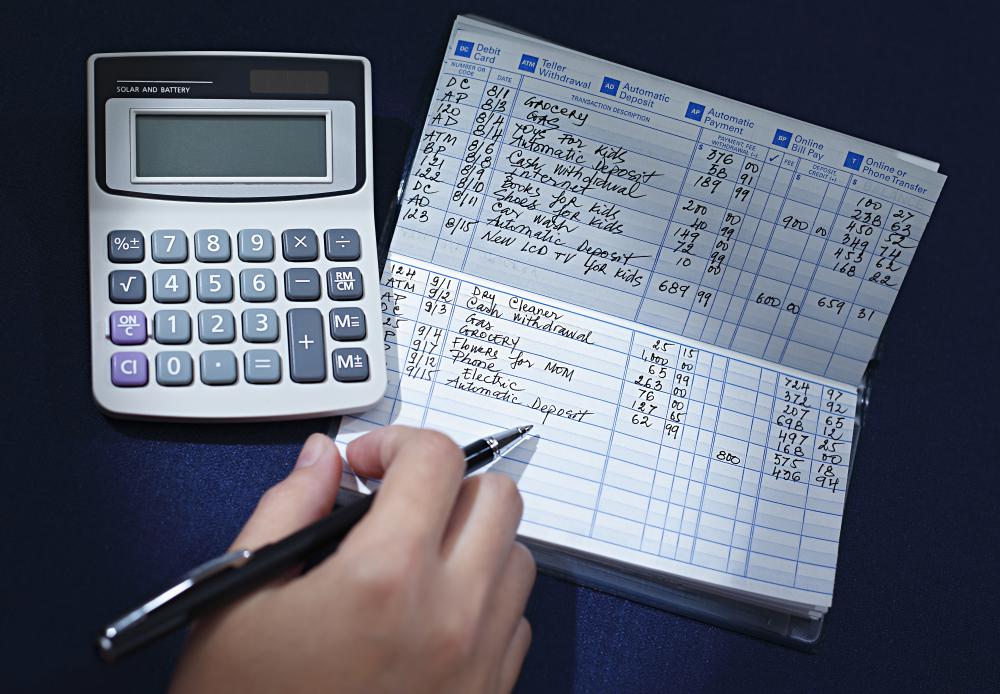

For both companies and households, the task of reconciliation with the bank usually involves comparing the line items on a checking account bank statement and the entries in a checkbook register that relate to the same time period. Among the important line items to verify are check numbers and the amounts associated with each check number. This can often lead to discovering any small discrepancy between the account balance shown by the bank and the balance reflected in the checkbook.

Along with the check information, it is also important these days to compare ATM withdrawals and purchases made with the debit card associated with the checking account. Unfortunately, many people fail to record these types of transactions in the checkbook register, which will throw the personal financial records off.

Another factor to take into consideration when reconciling the checkbook with the bank statement is any type of authorized withdrawals, such as monthly utility payments, mortgage payments, or insurance payments. Remembering to add these items to the check register each month can make the stress of reconciliations much lower, since the addition helps to preclude any surprises when the bank statement arrives.

Last, it is important to verify the record of deposits found between the two sets of documents. Once all these areas have been addressed, it is relatively easy to see what needs to be done in order to go about adjusting account balance information so that both sets of records agree on the current status of the account.

One should not be distressed if a bank reconciliation shows a small amount of difference between the amount shown by the bank and the amount shown in the register. Simple transpositions of numbers or failure to record a transaction often account for the discrepancy, and can quickly be reconciled. However, it is important to note that while bank statements are almost always correct, it is possible for a bank error to occur. When a bank customer is unable to locate the origin of the discrepancy, it is always a good idea to contact the bank and schedule a time to go through the transactions together. Often, this will lead to a full bank reconciliation.

AS FEATURED ON:

AS FEATURED ON:

Discuss this Article

Post your comments