At SmartCapitalMind, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

What Are the Different Types of Macroeconomic Policies?

Macroeconomic policies are divided into two main types of policies. The first is fiscal policy, which relates to government initiatives such as taxation, spending and borrowing. Monetary policy is the second type, and it involves currency policy such as devaluation, cash flow policies such as quantitative easing and policies that are designed to control interest rates. Many governments employ both of these types of policies.

Governments decide which macroeconomic policies to employ based on a broad range of economic indicators. These indicators include the value of all goods and services produced in a country, which is called its gross domestic product (GDP). They also include the percentage of people who are unemployed. Other indexes include interest rates, average salaries, average household debt and price indexes.

One of the most important and varied macroeconomic policies is taxation. Taxation determines how much money individuals and companies have to pay to the government, and therefore also how much money the government can spend. Governments are able to set tax rates on personal income, inheritances, sales and other taxable actions to generate money for public services. Governments try to strike a balance between low tax rates for people or businesses and higher tax rates that generate more money for the government to spend.

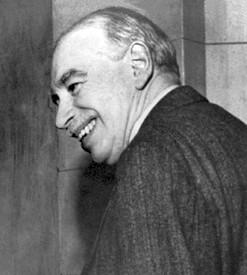

John Maynard Keynes, other economists and many world leaders have advocated using the government payroll to reduce unemployment and to try to boost the economy. Each new government job takes a person off the unemployment register but adds an additional expenditure to the government’s finances. Keynesian economics dictates that full employment generates consumer spending and therefore stabilizes a failing economy. Other economists, however, believe that it creates a debt spiral like those seen in the early 21st century in countries such as Greece, Portugal and Ireland.

Governments go into debt by borrowing money. Borrowing money allows governments to maintain spending while income is falling or allows them to increase spending. A fiscal policy based on borrowing is determined by the interest rates at which the loans are repaid. The rates are determined by the ability of the country to repay its debts. As an alternative to borrowing, governments can reduce spending, which might lead to greater unemployment but reduces the interest rates that the government, banks and businesses have to pay.

One monetary policy that governments use to ease spending shortfalls is called quantitative easing. This basically allows the government to print additional money without devaluing the currency. In theory, the money is allocated to the banks, which then loan the money to businesses, allowing them to employ new workers. A devalued currency works in a similar fashion by generating extra income, but it weakens the actual currency and harms the country’s trade balance between imports and exports.

Other macroeconomic policies include controlling interest rates and demand management. Controlling the interest rate can increase or dampen consumer spending. A high interest rate can cool an economy that is about to overheat, and a low interest rate can stave off a recession.

Demand management macroeconomic policies work in the same way. By releasing or withholding additional resources or by creating new products, a government can raise or lower prices of particular resources or products. Middle Eastern governments use this type of policy to raise or lower the price of oil.

AS FEATURED ON:

AS FEATURED ON:

Discussion Comments

There are basic errors in the description above. It may apply as stated to non sovereign economies because they are constrained as users of currency. This is where the household budget analogy applies.

However sovereign governments are not in any way constrained by taxation revenue. Federal governments do not need to borrow. They can simply credit the bank accounts of their creditors. Sovereign governments cheques do not bounce.

Sovereign governments are issuers of currency. The only limit to this is inflation. The household budget analogy does not apply to sovereign governments.

@fBoyle-- I think that governments prefer to use monetary policies first when dealing with an economic problem. There is usually less time lag when implementing monetary policies. Fiscal policies take longer to put together because of bureaucracy and it also takes a while to see results.

If monetary policy doesn't work, then usually fiscal policies will be used to support monetary policies. So we can say that these two go hand in hand.

@fBoyle-- One is not better than the other because they deal with different things.

Both types of macroeconomic policy aim for sustainable economic development. Fiscal policy works to stabilize the economy by adjusting government spending and taxes. Monetary policy does the same through interest rates, banks' money reserves, etc. Congress decides on fiscal policy and the Federal Reserve decides on monetary policy.

Which is the better and more effective macroeconomic policy -- fiscal policy or monetary policy?

Post your comments