At WiseGEEK, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

What are Resulting Trusts?

With the name derived from the Latin word resultare, which means 'to jump back', resulting trusts are trusts that are implied in settings where one party transfers property to a second party, who pays nothing for that property. Under such circumstances, the court presumes an intention of the original property owner to create a trust, in which the possessor of the property holds that property for the benefit of the original owner or another person.

A trust is a legal arrangement in which an asset — whether tangible, intangible or real — is controlled and overseen by a trustee for the benefit of another person. There is no intent for the trustee to own or benefit from the asset. The trustee bears a fiduciary obligation to the beneficiaries who are the "beneficial" owners of the property. There are many purposes for express trusts, including asset protection, privacy, tax planning, spendthrift protection, and estate planning.

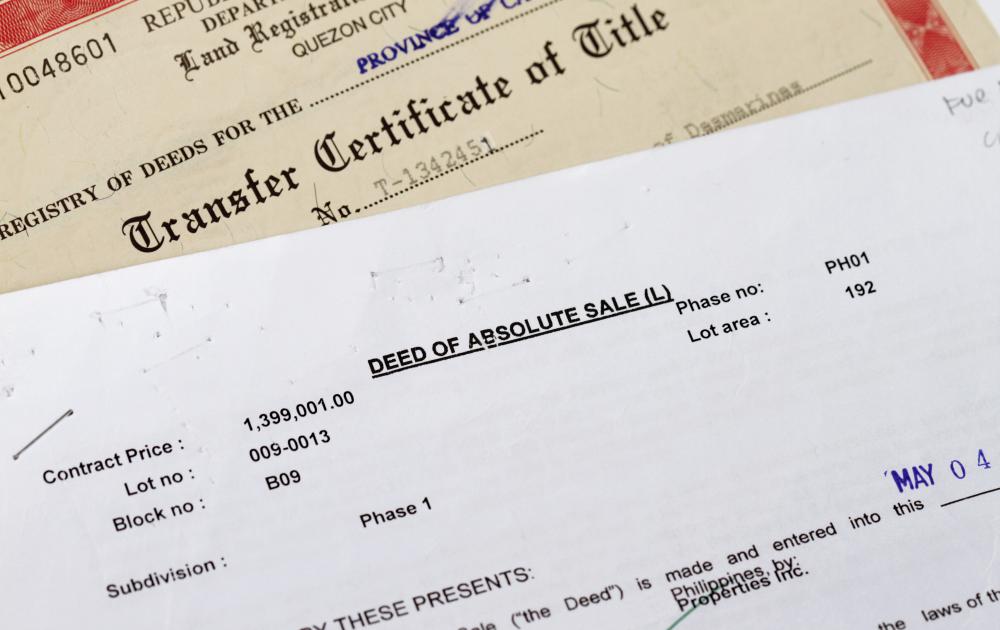

Resulting trusts can be created in a variety of ways. When an express trust fails, such as when the beneficiary dies without the settler’s knowledge, a resulting trust is automatically created. That trust's assets revert to the settler or the settler’s estate. Another scenario in which resulting trusts occur is when a purchaser of an asset, such as real estate, assigns or deeds the purchased asset to a third person, with the implication being that the third person is holding the real estate in trust for the purchaser even though the third party legally holds the title.

For property or money transfers between close relatives, some courts establish rebuttable presumptions of a gift, which may be used as a defense against petitions for resulting trusts. The presumption of gift applies to property transfers from settlers to children, grandchildren, siblings, aunts and uncles, but it does not apply to spouses, for whom a fiduciary obligation for fair dealing and good faith exists. For example, when a married couple converts the title to a jointly held marital asset, such as a home or real estate, to single ownership for estate planning purposes, the property remains marital. Converting such types of property to non-marital status can only occur under strict circumstances. Resulting trusts are implied when one person pays another person and the money is not a gift.

The laws regarding resulting trusts exist to prevent a transferee's unjust enrichment. In those circumstances in which a person transferred property, the courts may decide that the transferor has waived his right to assert a resulting trust. Most jurisdictions do not let a cheater use the courts to benefit from his unlawful transaction, known as ‘unclean hands.’ Other courts may choose to disregard the purpose, unlawful or not.

AS FEATURED ON:

AS FEATURED ON:

Discuss this Article

Post your comments