At SmartCapitalMind, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

What are Prepaid Credit Cards?

Prepaid credit cards, more accurately known as a secured credit cards, have a credit limit based on a security deposit the account holder must make upfront. In all other respects, this type of account functions like a standard unsecured credit card. Credit accounts of all types require that payments be made on time and the account be used responsibly, but a security deposit lowers the risk to the bank, making prepaid credit cards easier for many people to get.

Credit vs. Debit

Prepaid credit cards are different than prepaid debit cards. A debit card deducts funds from the amount of money deposited into the account associated with it, whereas a credit card makes purchases on credit, which must be repaid using funds from another account. In the case of a secured card, the funds used to pay the bill cannot come from of the security deposit in most situations.

Many people look into this financial solution because of poor credit. A prepaid credit card will improve a person's credit only if payments are made in a timely manner. If timely payments aren't possible, a prepaid debit card may be a more appropriate solution, since the money will be automatically deducted.

Getting an Account

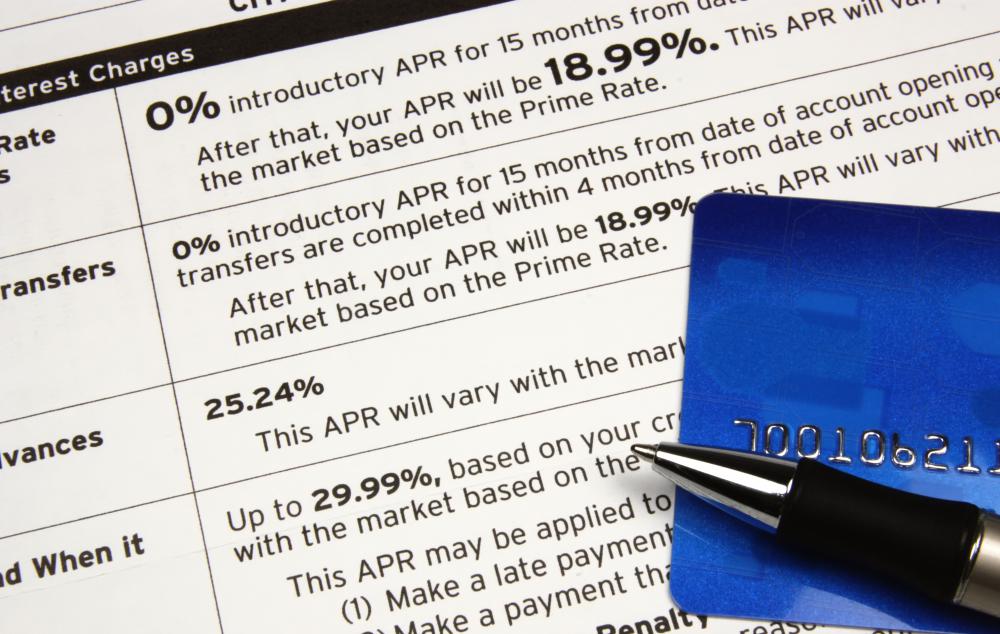

To open a secured line of credit, an applicant must first find a company offering this service. Prepaid credit cards may require an application fee as well as an annual fee. The amount that the issuing company charges can vary widely, so applicants should thoroughly research any card they are considering, along with the company and the credit contract. The person will have to apply for the card as with any other credit application.

Once approved, the person will need to set up the account and pay the security deposit. The amount of the deposit is typically the same as the credit limit; it may be possible to increase this limit if more money is later added to the deposit. Once the money is deposited, the account holder is issued a physical credit card that can be used just like any other.

Usually, the person who opened the account will be sent a bill each month for the amount of money he or she has charged on the card. Each company has its own policies, however, and all bills should have their due dates clearly stated. If a payment is missed, the account holder will likely be charged a penalty, and any amount that is not paid off at the end of the billing cycle will have an interest charge — some percentage of that original amount — added to it.

Advantages and Disadvantages

People with poor credit are often eligible for a prepaid credit card even when they may not get approved for a standard one. As such, it is often used as a way of building good credit. By making regular small charges and paying them off each month, borrower can show that he or she is financially responsible. In many cases, after a year or so of making regular payments, a secured account may be converted to an unsecured one.

Many prepaid credit cards are subject to very high fees and interest, however. This means that, if the charges aren't paid off each billing cycle, the amount the person owes may grow quickly. This can make a secured account riskier than other types, because the security deposit may be forfeited if the borrower cannot pay. Additionally, the security deposit may not earn much interest, and it cannot be accessed easily by the account owner.

In some cases, a prepaid credit card may be "flagged" as such on the borrower's credit report. This tells other potential creditors that the account is secured, and can make it more difficult for the person to improve his or her credit. A person who is already struggling with financial problems may find that these disadvantages only make the issues worse, defeating the potential benefits of the card to improve the person's credit rating.

AS FEATURED ON:

AS FEATURED ON:

Discussion Comments

I prefer prepaid cards like paysafecard instead of prepaid credit cards. It is not linked to your account, it is totally safe and you are always in control of what you spend.

My husband and I interested in a pre-paid credit card. Does the amount of security deposit you put on the card depend on the card company?

I have a BMO Prepaid Travel Mastercard. I have been a Bank of Montreal customer for years so there was no issue with getting this card. I have used it for hotel purchases all over Canada, the US, Abu Dhabi and South Africa. I have used it to rent cars in Canada and the US. I have not had one issue. It works just like a credit card.

I am concerned, however, about an upcoming trip to Europe where I would like to rent a car as I think their policies are different. This Prepaid Mastercard does not have Chip Technology built in and I am worried I will have trouble. Can anyone weigh in on this?

I just read this article and found it very helpful regarding credit cards and debit cards. Thanks for sharing this information.

Both cards are very useful but I like debit cards because a debit card deducts funds from the amount of money deposited into the account associated with it, whereas a credit card makes purchases on credit, which must be repaid using funds from another account.

I am glad this is being discussed as I have my two cents to add, of course!

I believe that prepaid cards are ideal for online purchases. Using them day to day is cumbersome and if you don't know how to handle a CC, just use cash.

Online purchasing is a completely different ballgame and using a CC can be privacy infringing as well as dangerous, as it could open you up to CC fraud. This is why I prefer to use a prepaid card when making purchases or gaming online. These cards can be bought at any local gas station or convenient store and then used all all major platforms such as itunes, amazon, steam, etc. It is safe because there are no accounts, names, or registrations attached, and it is easy because anyone can get one and you don't need to deal with accounts or verifications. Happy shopping!

Can I use my Netspend card to accept payments on Amazon as a seller?

Warning: for those of you who are thinking about getting a prepaid credit card, think again. They are not accepted at car rental agencies and most major hotel chains. They cost you money, so why not just use your bank debit card and save yourself the headache.

I have Netspend and it does not report to Bureau. But it's a great card. I pay $5 a month for unlimited transactions, plus they give you a ten dollar cushion.

Most of the prepaid cards operate the same way as debit cards. When making a payment, the issuing institution transmits a signal of "no credit guaranty", so that is why in some cases they get refused on aircraft or at the car rental counter.

The situation is changing in Europe, though. The issuing institutions execute a customer due diligence procedure which requires new clients to identify themselves by submitting a number of documents such as IDs, existing bank details, regular payment of bills, etc. Depending on that, they allow broader transaction possibilities. Car rentals on their behalf, especially to the popular vacation sites, are more apt to accept known brand debit cards (such as MC/EC/AE/VISA) for payments, provided that a customer purchases full coverage insurance. Since prepaid cards operate the same way, this is good European news for their holders.

I have had the Netspend card and I hate it. They charge you a dollar for each transaction. The rush card reports to PRBC, but PRBC is not a major company that card issuers look at when offering credit.

I have a Kroger prepaid card. It is three dollars to load and three dollars a month and the rewards do work. I've received ten dollars on the card twice. You earn points no matter where you shop.

I don't know if any of you use American Express, but their card is free to use (the prepaid one) if you load it from bank account 495. It has no transaction fees to load and no monthly fees except for the load fee and of course with any card, an ATM fee unless you use your bank ATM. Does anyone know if the Orchard secured card is good?

Amex has some great prepaid cards. Try the PASS or the regular card. Anyone can use both of these cards and they can be reloaded from bank accounts or another amex card. The fees are much better than with other cards. In some cases you can use them free if you don't need more than one atm visit in a month.

To me all of this is a bunch of bull. I was wanting to get a prepaid credit card just so I wouldn't be carrying around cash all the time. I don't have much money, so I am only talking about between $20 - $300. Probably averaging a $50 balance. So when I looked up what it cost to have one of these cards I couldn't believe it.

After you pay to activate it, pay to load it whenever you want to add more money to it, pay each time you use an ATM, pay to make a purchase, and of course the monthly fee to have a card with your own money on it, it doesn't make sense to me. You are putting your own money on a card, but they want to charge you for every time you touch your card. It's not like it is their money you are using.

By the time I paid all the fees they want to charge, I wouldn't have any money left on the card. Call me crazy, but I was, let's say I wanting to put $200 on a card, I thought maybe I would be charged $5 - $10 for the card. And a fee of a couple of dollars to add more money to it, and I could even understand $.50 - $1 to use the ATM. I just can't get into paying someone all that much money to spend my own money. Sorry. I guess it will stay cash and carry for me.

I've noticed that all the cards we have looked at can only be used within the US. Are there any prepaid cards that can used in Costa Rica? We are taking our grandsons there in February and want to put their spending money on a prepaid card rather than having them carry cash around.

The best card I use is a pre-paid Visa card from Money Mart. You can load up to $10,000 on the card. No, the pre-paid credit cards do not affect your credit ratings, either good or bad.

The Titanium Visa from MM has some amazing features. It is $20 to load a card and $15 per month and most of the activities are free. You can even get your salary deposited to the Visa. You used have to give a form to your employer. Most of the car rental companies do not accept pre-paid cards as there is no credit attached to it. You can get the pre-paid Visa for 16 years and over. You can also get the $7.50 per month package if you do not use the card often.

I applied for a pre-paid mastercard at capital one. these people gave me so many problems when I tried activating my card. I sent all the necessary information they asked and they still would not let me activate my card. The reason they gave me is I could not verify my address. this is the reason I applied for the pre-paid card? Can anyone tell me what I should have done?

I had some bad credit card experience before so I prefer using prepaid cards whenever I need to pay something online. Paysafecard is my fave because it has no hidden charges.

well, i have a secured card through capitol one. i just applied, made a deposit, which is my limit and is there just in case i default. in about 18 months, if i have a good payment history with them, i will be refunded my deposit and given an unsecured card with a higher limit. basically, it just shows your trust worthy and serious about rebuilding your credit history, and the deposit is "just in case" it works, my credit score has gone up in the last six months since having it.

For all trying to build a credit score. I am a successful businessman who can afford not to use credit which is how I have chose to live. I only buy what I can pay for at the time. I save money.

For more than 10 years I did not use any type of credit. I was not even in the system (score = 0). I decided to buy some land and I did need to borrow. I knew that I must have credit and that it would take planning.

So I deposited money in a local bank. Then I bought a cheap used car paying half down and financed the rest at the local bank where I had funds. Made my payments and about six months later I did this again. I got an in store credit account at a local furniture store and used that. Making my payments on time, in full. It took about two years of this but now I have a house and land.

Advice: Live within your means. Work harder if you want more. --jla

i owe child support and every time i put money in a bank they take it. is there a card i can get that this won't happen?

This is nonsense! I just purchased a prepaid MC just to find out it will not work overseas in Europe! Aargh!

If I left my prepaid credit card at a restaurant and someone else claims it and uses it, what is the traceability procedure?

As I had suspected, my Link prepaid MasterCard can only be reloaded through Northern Store, valu Lots and North Mart.

I do know that you can load funds to other prepaid credit cards from one's bank account.

I am going to check other prepaid credit cards if they would make an adequate substitute. For the one I have been using.

As the saying goes, if it ain't broke, don't fix it.

Personally if I ever open a checking account, I would still use my prepaid link MasterCard. I find my prepaid MasterCard reliable. Good for shopping, online and bill payments. Considering that 1.00 fee per a purchase is not bad.

If you're Canadian or have been naturalized as one, tThere is Zoompass prepaid MasterCard and BMO Travel Mosiak MasterCard.

With zoompass, you'll need a mobile to sign up. But I would strongly recommend that you read the faqs. The upside it's available to most carriers.

But with BMO travel Mosiak MasterCard, in order to get their prepaid credit card you would need to go through a credit check. Pass their credit check and you'll have to open a BMO checking account, just to first load and reload it.

For all of you who think that your credit score is the only way to get the things you want in life, you are fools.

Try paying cash for food, shelter, lights, water, transportation, etc. Live on less than you make and work your butt off and you won't be a slave to your 'I Love Debt Score'. If you can't do that then you can't afford to buy whatever it is you planned on getting anyway.

That way next time Capital One asks you, "What's in your wallet." you can respond, "Cash."

Enjoy your credit card bills.

Prepaid credit cards seem interesting! When using them, can you build credit the same you would with a normal credit card?

Unfortunately, not all consumers know about emerging forms of credit like this. For those individuals left in the red by "classic" credit, companies like DebtGuru are there to help. By working with individuals and banks reduce or eliminate accrued debts, they have already allowed many people to get back on their feet. Their credit counselors are very helpful!

Saving a large amount of money in a year would really help me build up my credit. In the meantime I am doing consumer credit counseling and it is really helping.

I hope my info will help someone. Debit cards are useless for a credit score. I have two, which I have used for years. This is no more than paying cash, but with a card. It does not help one bit to improve your credit score. You need a regular credit card, period.

I'm in that situation now. I need a regular credit card, and cannot get one. The system is not the way should be. I have to resign myself to the fact that I will never be able to buy my home. Not now, or ever. --xmb

Don't use MIO. I got one of these cards and was told that the only fee was when you loaded the card. I used it for a few weeks with no problems.

One day I was trying to order something online using the card and it would not go through. I called the company and found out that they had double charged my account about three times. Plus, they were charging 50 cents per transaction. This they had not told us about.

I closed the account and was told that they would replace the money that they double charged and send me a check. I have not gotten a check. All I have gotten are promises, but these people stole my money. Don't go there!

I cannot get a checking account at a regular bank so can I still get a prepaid credit card?

Prepaid cards are very useful. My son plays different online games and I don't mind giving him some money for that but I don't allow Paypal and credit cards for this reasons. I buy him Paysafecard worth £10 and he's happy with it for a while.

Misterboot, yes, your prepaid card is similar to Paysafecard.

I use mine not only on Amazon, with Skype, but also for gaming (can't help it), BiteFight and Mafia + Vampire wars on Facebook and some others. Many others use it for online betting. Not my thing, but it's really great with all these possibilities.

Usually they have some promotion on their site, giving away free cards. Right now there is couple of them running. Apply and see how lucky you are. If you get it, you will fall in love for sure. Not just you, though.

P.S. If you're running low on one of your Paysafecards, you can sum it up with a new one, so no money is lost. It's a nice option. -Dana

@ 105. Hitting the little snag I'm talking about is insufficient funds, overdraft fees. I sometimes run low on funds on the card. Obviously due to using it.

It's good that you're using a prepaid credit card. And the bonus of a prepaid credit card is that it doesn't charge interest rate and offers no line of credit. Personally Dana, I think prepaid credit cards are practical tools for someone with a wallet or purse. Not to mention that it would save someone from pulling his or her own hair out.

The one I have is a prepaid Link MasterCard. I got that one from the local store and it can be loaded at other branches.

The good thing about prepaid credit cards is that you can use them for online purchases. I use it mainly on amazon and my telephone bill. But I have to make sure to remember to reload it when my telephone bill statement is mailed.

My cousin uses hers to order groceries from out of town, via telephone and to pay for her telephone bill.

I have had a green dot mastercard for two years. I have paid my at&t, electric, e-bay, and many more bills with it. If you sign for purchases instead of using your pin there is no charge.

Misterboot, I don't know about that one you mentioned, but I live in Europe and use the Paysafecard. There are no fees at all, and there's no way you can go over the limit. But if you have some money left on the old one, you can use all that is left merging it with the new one, so it's fully practical and economic. They can be purchased at every corner and in various amounts, and now even online.

I stopped using CSs and the likes when I heard about this one. A real savior. -Dana

Sometimes with prepaid credit card, you can run into a little snag now and then. Don't let that spook you.

Even though prepaid credit cards are handy, sometimes customer service can be a little crappy and even extremely incompetent at times.

As I stated earlier, that maximum daily loads varies between each issuer.

Actually 10.00 was levied on my prepaid credit card when I paid for 32 litres of gasoline (half of tank of gas), fortunately I had cash on hand to purchase some fuel.

Actually with a prepaid credit card, you can't impact the credit rating. Monthly fees varies between the issuer of prepaid credit card.

And the daily loads also varies, from 1500.00, 2500.00 or the 7500.00 per a day

There's the prepaid mastercard and prepaid visa card. Nextwave Visa (Titanium plus Visa), Nextwave Mastercard (Titanium plus MasterCard), Iridium Mastercard among others.

But then again those are Canadian prepaid credit cards. I would recommend in choosing wisely which prepaid that would serve you well.

There are some limitations, you can't exceed how much you load in your card. And overdraft fee is another.

Personally, living in the far north, in Northern Canada. I find it useful in making payments, and renewing my subscriptions. It saves me money on stamp and money order fees. Even though 1.00 was deducted from my card per each payment,

if I go over the limit, a 10.00 fee would be levied on my prepaid card.

Oh yeah the one, I use is prepaid Link MasterCard. I have yet to try it on my local cable and internet provider and local electric provider.

If you're looking for a way to purchase online, then regular prepaid cards are much better solution.

Paysafecard is exactly what it says and that's why I use it. You just choose the amount when buying the card. You'll get 16 digits code which you enter when making a purchase and you're done. No more dealing with credit card frauds and similar, thank you very much! --Dana

Is there a minimum amount of money i have to put on he visa prepaid credit card? Like i want to put $5 on it after i pay for a $5 fee.

For the record: To those that use credit cards at the pump. The moment you slide your card into the pump, a 75.00 hold is put on your account. But if you have that extra minute or two and go inside, they can and will only charge the amount you are getting. some places will hold your card until you have finished fueling your vehicle.

I was going to purchase one today, but I heard that if I had any problems with it,it wasn't refundable. I was going to put almost $200 bucks on it, so I could purchase something online. I don't know what to do now.

I've always been careful with all of these cards, however I found one that works great for me. The Vision Prepaid Card is a Visa card. We have the platinum card where we paid a high activation but no other fees (any at all) for life. They also have the premier card if you don't mind paying a monthly fee.

I believe that one won't charge you for using it like others do - not sure, worth a visit to their site.

You can buy pre-paid cards from CVS, Walmart, Walgreens. The green dot card is a good one, and depending on where you live, try a smaller Enterprise location. You will need to show proof of employment and address and you can rent a car with a prepaid card or money order. This does not post to your credit, if you are trying to rebuild your credit try a secured card or get a credit card with Orchard Bank.

I'm trying to order something online, but it asks for the name on my card. My name is not on my prepaid credit card. what do I do?

Anyone know what the best prepaid card is for online purchases? I tried a Visa Gift Card and it was rejected by the seller, because they could not verify my info.

You cannot use a debit card for everything. You cannot rent a car with a debit card. They charge you a $500 deposit and run a credit check. My credit is not good so they wouldn't let me rent a car. This is why you need a prepaid card.

I want to subscribe to non-recurring web sites and make purchases. The article above seems to support these would work. Anybody use a pre-paid for internet purchases?

Lost our pre-paid card with $100.00 credit on it. how can I get my money back?

@ post 79: I think maybe you'd run into problems when you have to use those CVV numbers that are on the back of credit cards, wouldn't you? I don't think debit cards have that -- at least, mine doesn't. But then, mine is Canadian so maybe you are in a different country where that doesn't matter.

@ post 82: My prepaid card was accepted by paypal. Did you know that in order to add a credit card to your paypal account it costs you a small fee? I can't remember how much, (only a couple of dollars - or maybe $5) but maybe what happened was when you tried to add it the card didn't have enough on it for that fee.

I haven't had a problem with either of my prepaid cards - BMO or Horizon Plus - except for when I hadn't put anything on my card before adding it to my paypal account.

This is stupid. i wanted to buy "points" in a game but paypal doesn't accept prepaid credit cards. what do i do?

The MiCash Card is one of the better prepaid cards out there. It is issued by Metabank under the MasterCard logo, has real humans you can reach on the customer service phone line, has low fees, and requires no credit checks or bank accounts.

There are no finance charges or overdraft fees because it is not a credit card. It does offer iAdvance short term loans, which when you pay these loans back are a way to build credit history.

Is Canvas Visa prepaid gone belly up? They closed my account with money in it.

Just get a free checking account at any bank and you'll get a debit/Visa card for free. No charges or anything. What's the point of dealing with a prepaid card when anyone can get a free checking account that included a debit/visa card that can be used like a credit card anywhere?

everyone listen: using a debit card you can buy airline tickets, get a hotel just about anything that has a mastercard or other big name logo on it. I have never owned a credit card and i use my debit card for everything.

Can you overdraft on a prepaid visa? And say I wanted to purchase items online, would this be a safer alternative to use than my regular credit card. For example if this card's account number was stolen and I only had $10 on it the thieves would only receive $10 compared to if they stole my debit card number and had access to all my money.

Well, any pre-paid card has a seven-digit CVV or security code? if yes, how would we enter when on few websites only three digits are allowed in the CVV field?

To #73: It's generally the last three numbers of the seven that are the CVV code. Often the numbers are grouped up in a set of four and a set of three, in which case it's the set of three that you enter.

And yes, to my knowledge all prepaid cards (note: I don't know about *gift* visa/cards) will have this kind of security number on the back.

I run a company registered in california. I would like to issue prepaid credit cards on my company name. Is there a company which can take of issuing these prepaid cards on my company name?

Well, any pre-paid card has a seven-digit CVV or security code? if yes, how would we enter when on few websites only three digits are allowed in the CVV field?

My favorite prepaid card is the Futura card. They have the best customer service and now that I have direct deposit on my card I don't have to bother going to a bank to cash my paycheck any more.

A pre-paid card that I've had a lot of success with, and reports to the CB's is Ultra VX. I have never been on hold to their customer service for more than two or three minutes, and I have not had an issue.

It is more like a 'secured' card in the sense that you have a minimum payment just like a real credit card, but it reports your payments, and you can have a max credit limit of 25,000. (And yes, the payment that you make is available to spend as well).

I love this card, and recommend it if you are trying to rebuild your credit. They give you several options to 'load' money onto the card, such as paypal, direct deposit, etc.

I have tried many prepaid cards over the years from banks such as BMO, HorizonPlus and others and have found they all screw you on fees and offer terrible customer service. I use prepaid cards regularly for small cash purchases like coffee, lunch, newspapers, magazines, as well as my online purchases. I do not like putting all these small charges on my credit card. I recently discovered an awesome prepaid product called Zoompass that I want to share with you all. The Zoompass Prepaid MasterCard is absolutely free to get and free to use. Now for the coolest part – Zoompass gives you a free application for your mobile device (I use a BlackBerry) that lets you check your balance, view your transaction history, and reload the card from a linked bank account. The coolest part was I was able to send money through the Zoompass application on the phone to a friend I owed money to! This really is the future of electronic cash.

Can you fund a prepaid credit card with another credit card? (For my college age kid)

the problem with these, and i have two of them that i am frustrated with, since they sold and changed banks, is that netspend now has no way to talk to a human, so your screwed there. and western union has them, but like most others, will hold a percentage over the amount you charge for certain things. it's not the hotel chains that charge the fees. most will hold for $10-$35, but will immediately release when they run the bill on checkout. but the card companies will hold for up to 90 days as most state laws allow, which is really a form of fraud, since none of this is covered in the practices and policies sections of the user agreements. in all honesty, they are all a shot in the dark whether they are good or bad. but most are funded by overseas banks, as you will see when you call customer service and get someone with a russian or middle eastern accent. is there nothing that is american owned any more?

Funny thing about getting loans. You generally need a good credit history for that. lol! So, if you are trying to recover from bad/no credit, you are less likely to be approved for a loan. Unless you know someone in management. ;)

if you can, taking out a loan and paying it back on time also builds credit.

where do i get pre-paid credit cards? how much does it cost? do i need to pay extra to get a prepaid credit card?

I use Green Dot and my card is to expire at the end of the month. Will they send me a new one?

Can you use this card to pay on ebay?

LOL! You are funny!! I used the asterisks for what likely is the same reason you used uppercase - because I wanted to highlight the phrases/words but there wasn't a bold or italics option that I could find. : )

Thank you for the suggestions for building up my credit. I never thought of those options - in fact, I didn't realize there were places that still did 'rent to own'. I knew from the start that the prepaid card wouldn't do a thing for my credit, but I got it because it was necessary for things like - well - booking airline tickets and staying at hotels. My young son has to go to the city a couple of times each year for specialist appointments and we don't know anyone there to stay with, so our only option was to find a hotel. Sure, there are some that accept cash, but most of them are not the kind I would take a 5 year old to (not very well kept/clean etc). I don't know what to do now that the hotels are not accepting prepaid cards. Even though I will *eventually* get some credit, my son's appointments can't be held off until then.

you made that story up, right? besides, isn't "prepaid credit" an oxy*moron*?

i stand by my original post; a "prepaid credit card" is what one gets his 14 year old daughter! kind of like those retractable leashes for dogs; lets them pretend they're free to run even though they're really not!

in all seriousness, however, there are many possible answers to your question. might i suggest a "buy here-pay here" auto or perhaps a "rent-to-own" big screen television as a more effective means of establishing a credit rating? well, *as effective* atleast! my question for you is: "what does *it* mean when you randomly *place* asterisks in your writing?

I am a 42 year old stay-at-home-mom who has been married for 15 years and am now just starting to try and build some credit for myself. Or rather - tried to...but like one of the other previous posters of similar circumstances I am finding that "no credit" is worse than "bad credit". I have had a Canadian Prepaid Mastercard for about 3 years now. It has worked wonderfully for airline tickets at WestJet and the few hotels I've had to reserve/pay for when taking kids to the city for health appointments.

At least, it worked well until this past March. I made and confirmed my reservation at a hotel which I have used before *with this same* prepaid card, I got all the way there (6hr drive with sick cranky child), go to sign in, and was unceremoniously informed they don't accept prepaid credit cards.

Now, my issue with this (besides my new bias against this hotel) is that in my research on this subject I am learning from several financial advisor types that the problem with hotels (and such) not accepting these prepaid cards is that they can't preauthorize a prepaid card. Not true. At least, not true of the one I use (Horizon Plus). Gas stations have pre-auth'd, this *same* and other hotels have pre-auth'd in the past, and I have never had a problem. So, I don't get why suddenly these same places won't accept them. There was *more* than enough money to preauth an entire weeks stay twice over and I was only staying for *one* night. I even offered to pre-pay the entire thing *plus* have them 'hold' the same or greater amount again. They wouldn't even check it to see - they simply refused. The card has my name on it and everything. Can anyone here offer me a better explanation as to why these places do that when pre-authorizing/holding funds *is* possible on such a card?

Now that I have registered with the Payzone prepaid Mastercard, I find that when I went to load my First-Time Loading card, that the card was declined.

Yet stupid Payzone has nothing in their FAQ addressing this problem. I check my account on-line to see no credit, and yet I cannot load with any credit anyway. Has anyone come across this problem, I sent them 3 emails but this was on last week, this is supposed to be transformism, replies are supposed to be instantaneous, it's the internet.

I realize now that the people who issue the worldwide prepaid Mastercard are a bank based in Luxembourg, so this should be OK, hopefully they don't expect me to have a bank in the UK, if you are within the EU, that should be safe enough, hopefully someone can confirm this for me.

Can anyone see or know about the money on your card? Do these cards report anywhere? I know not Credit Bureaus, I'm wondering anywhere? Anyone? I'm not trying to build credit.

*Do not use the* NetSpend Card!!! It's a scam! They charge for Loading the card, for withdrawing money $2.50 for every $400.00! So, if you have to withdraw $500.00 you pay $5.00! Every time you call to check your balance you pay and if you call customer service *you pay* $4.95!!! And to top it off, this may shock you...the company does not care about Customer Service!!! Nope, not at all!

I've just ordered a Payzone Worldwide prepaid Mastercard and hope to make a purchase from a store in Boston, US. When I was looking at their conditions for international payments they mentioned this. " We verify the authenticity of all card holders and you will be asked to supply the name of the bank that issued your credit card and their phone number along with the security code." Now Payzone has an office in England and Scotland, what do I supply for a bank address, do I supply the Payzone Scottish address (where I'm living) and phone number. I've been trying to get this item for ages, but my Maestro card won't work, as the site only accepts Vista and Mastercard. I can't imagine there being a problem as credit will already be loaded in. Did anyone come across a problem like this? I'm awaiting this card in the post, will it work with this site.

Cheers for any info in advance.

If I won the lottery, I want to give family members money. I was thinking about pre-paid credit cards.

Is there a maximum amount you can put on a pre-paid credit card?

I have used the Green dot card system to load money to my prepaid card with Account now. Its not bad to have if you live in the bay area their branch is located in Pleasanton CA. If you have direct deposit you can also apply for a cash advance through iadvance as long as you have direct deposit with (Metabank)a.k.a.. Accountnow- It doesn't matter if its visa or mastercard.

As for renting a car I have located one place in Oakland that will accept your debit card or prepaid visa to hold the deposit. Just so you know Alamo Hertz Dollar etc. Do not accept prepaid debit cards with visa or mc. They have a specific list that they will accept mostly those with a *bank* name such as Citibank B of A etc.-- Now Bank of America offers a prepaid Visa card along with you having direct deposit - I think its $29.00 to set up the account processing and fees, but you can use this card to rent cars hotels and more. I previously had one and I am planning to order another one this coming paypcheck. Its called Cashpay

prepaid credit cards are debit cards!

has anyone heard of the AccountNow Prepaid Card? I found their card on a card comparison site, I am interested because they say they can give you a line of credit, kind of like a payday loan. Wanted to know if anyone was using them?

The worst experience I've ever had with any company ever was with the issuer of my prepaid credit card; Next Estate Communications. I believe the card I had was marketed under the brand name "Green Dot", but I'm not absolutely sure. I am fairly certain that Next Estate Communications peddles prepaid credit cards under several different brands. Regardless of the brand name, I strongly recommend avoiding any product or service offered by them. Although my experience was limited to just the Green Dot brand, the problems I encountered trying to use it seemed to be of the sort likely to be systemic in nature; consequences of shortcomings at the organizational level, and therefore likely to be reflected in varying degrees throughout the company, across product lines, divisions and departments.

Do NOT use a Mio prepaid credit card! My husband and I have had a terrible time with it. There are all the usual hassles of a prepaid credit card, such as:

1) not being able to use it for any car rentals and most airline flights,

2) having hotels charge an outrageous deposit amount that ties up your money and is not released for a month without the hotel manager faxing a letter to MIO headquarters,

3) having gas stations hold $75 for a week or more for a purchase of gas of any amount below that,

4) having to pay a service fee each time you reload the card (with Mio it's $4.95 and Mio only allows you to load up to $500 at a time [once per day], although you can load it every day if you need more than $500 on it for a large purchase),

5) not being able to get a second card for another family member without paying an additional fee, and

6) only the cardholder whose name is on the card can get information over the phone; anyone else in the family (even a spouse) has to be "approved" by the cardholder to even be talked to by Customer Service.

I'm not sure if items 5 & 6 are customary for all prepaid credit cards or just unique to Mio.

Besides those hassles, Mio's website has been impossible to access for over a month now in order to check your balance and purchase history. Their customer service told my husband over the phone this morning that they're "working on it but it probably won't be accessible until Jan. 2009"! In order to check your balance, you have to call their customer service number every time.

They have not sent the new card (which expires every 12 months) despite repeated calls from us. Consequently, our card is now expired and we are unable to make online purchases and are in danger of having some of our services (which come out of our prepaid account as automatic deductions) cut off.

Since you can only load $500 once a day on Mio, it doesn't work for direct deposits of paychecks.

All in all, we're very frustrated and fed up with Mio and are looking for another prepaid credit card that will prove more reliable and more user-friendly. I'd appreciate it if someone would post the names of cards they've found to work better than what I've described above.

I looked around for the best deal in prepaid cards. I had never heard of it before but it offers a lot more than the normal prepaid card. It's called the Pr1macard. You can earn free phone minutes and use it as a calling card. I highly recommend it.

ARGH! I'm frustrated. I have no credit in my name. I'm 40 years old, have been married 21 years, stayed home full-time and raised and home-schooled three children. I get denied for even Sears and JCPenney cards because of "Insufficient Credit History". Teens still in school can get credit left and right. Guys at the bank told me I have two options: get someone to co-sign on a loan (which I don't want to do because the Bible tells us it's foolish to sign for another person) OR a secured card - but now am I understanding that these actually do NOT help to establish credit??

does it help build your credit?

i have one with international bank VISA...two years, no problems so far. Yes, they put your name on the card... and one correction...you can't rent a car with these cards very easily or not at all. Hotels will charge you an extra deposit, which you will get back after your hotel stay. They put a hold on the card when you buy gas for like 75, even if you get 10 bucks worth...but if you have bad credit, this card is excellent. Good customer service. Fees are reasonable.

do any of these companies for prepaid card put your name on them?

I'd like to set up an anonymous website online -- buying the url from a registrar and hosting on a free service. Can I use a prepaid credit card and never give anyone my name or address? As to recharging, I want to do this only in cash at a retail establishment.Possible? Any weak links I might have missed?

A prepaid credit card is great for those who want to fly under the government radar. There is currently legislation in Congress that would require all credit card transactions to be reported to the feds. Do you really want them knowing what you are buying? Can you say Ruby Ridge, Waco, FLDS?

I have yet to find a car rental company that will take a prepaid credit card to reserve a car. They say they will allow it to pay for the car once it's returned but not to reserve it. To reserve they said you need a regular line-of-credit credit card.

does anyone know where to get a prepaid card from a physical store (NOT online)? the only ones i have seen are the one time use gift card ones where you can't reload them. im having trouble with identity theft and am looking to get a reloadable prepaid card to minimize loss

Has anyone heard anything about the RushCard, and if so what is your opinion about it?

I'd like to know if you have to give any identifying or verifiable information to have a prepaid credit card. If it worked similarly to a prepaid phone card, that would be a big help.

This message is for those who wants to establish good credit. First of all, the prepaid credit card issuers do not report to credit bureaus. You would have to start establishing your credit by first obtaining a secured visa or mastercard, you deposit a certain amount of money (ex. $100) to so called CD account and you receive a credit card with $100 limit. Those banks report to all 3 credit bureaus, some report as a secured credit card account & some not. After a year the bank returns the deposited money and the account becomes unsecured, with the limit that you had. It is always a good idea to increase the limit before year ends, so you will end up with high limit card. There is a good website that offers both secured cards and bad credit credit cards as well as guaranteed approval cards regoardless of your credit, employment or income. You can visit that site and apply for a secured card even few cards each $100 or $150 to increase your credit score faster and higher. Each credit account is considered as a trading reference, more you have established - more credit you get from other creditors. Remember always make your payments on time and make little more than the minimum. Good luck.

dear anon5271, I have a prepaid credit card and i got mine at radio shack. You buy the card and put money on it. what you buy is the atm card. you go to the web site and register and they will send you the credit card

You don't have to get a prepaid credit card if you have bad credit. There are a lot of cards that will approve you.

To answer the question about rebuilding your credit with a prepaid credit card, no they do not report this.

However, if you are look to rebuild and need a credit card to do it then you can try a secure credit card (which if you ask me is the same as a prepaid card, because when you open the account your card is already in the negative) and they do report your activity. The major difference with this method is it will work just like a regular credit card, but you are required to make a payment before you use it or your available balance when you first get your card might be $50. You might be charged a higher apr, and they have a set min balance i.e. $20 month. When renting a car or something you will just have to have the amount available on your card as with a regular card. Merchants will not be able to tell it is secure.

Another way to build your credit is by going to your local credit union or bank and ask for a secure loan, or you can go to a local finance company and borrow a small amount I would start at $1,000. As with both options, (I recommend not spending the money, but putting the money to the side and using it to pay the loan back off) and make your payments on time and this is a quick way to improve your credit.

I checked out all prepaid credit cards and they all charge a lot of fees except one. There is no activation fee and no monthly if I use direct deposit. They claim it costs less than a regular checking account - which I can't get anyway. I've used it and they are pretty good.

Most of the credit reporting features for prepaid cards is a scam. You pay a fee (usually less than $20) and that payment is what is reported. Thought technically, they are reporting to credit bureaus, a $20 monthly payment will do nothing to improve your credit rating so you get nothing for your trouble. Netspend is probably the most well known and reputable company selling these cards. They have some cool mobile phone features like texting to receive your balance.

There is no such thing as a prepaid credit card really. It is a secured credit card if you put money on it first (and then technically there is no credit). Prepaid debit cards can be used like credit cards if they have the MC or Visa logo, but you cannot 'borrow' money you don't have. There are a few prepaid debit cards with these logos and each has different fees and features. The best one I have found is from a company called gteks. They have a card that is better priced than walmart on all its fees and they have a very important feature to me and my family called card to card transfer. It lets me transfer money to anyone with a card and to banks for only $5 or less. I can even use my cell to do the transfers. They also do not require as much of my personal info which was good. Hope that helps!

If there is no monthly fee, is there still a fee when you make a deposit?

I have been looking for a "Prepaid Credit Card", but all I have been able to find are "Prepaid Debit Cards" or "Secured Credit Cards" or "Prepaid Credit Cards" that are actually a membership you join and can only be used at their certain "club" store. Is there actually a "Prepaid Credit Card", that you put a certain amount on and you can't withdraw over that amount, period?

can i use my bread prepaid card to pay next a £3.75p

charge over the phone so i can place my first order with them, as they say the only cards they don't accept is electron or solo, but they did not say anything about not accepting prepaid cards.... any answers please?

Using a prepaid card is the best way to go in terms of shopping online (especially if its not a big name website.) The worst way to shop online is with your debit card especially if your pay check is being deposited to the checking account associated with that specific debit card. Remember you don't have the fraud protection as with a credit card. Timely credit card payments will bolster your credit ratings, while debit transactions do nothing for your credit ratings..(its your money from your checking account.)

What is a monthly maintenance fee?

Is there anything to distinguish this credit card from say, a regular visa or mastercard so that merchants/retailers would know that there is only a limited amount on the card, i.e. in the case of a car rental where they want to be assured you for any damage or non-return of the car.

Can I create a prepaid account under a false name? Is this the type of card illegal immigrants use? This might have some advantages if you don't like companies tracking you personal info.

If prepaid credit Cards is similar to that of a Debit Cards, then why should we go in depositing a decent amount in bank and obtain a Prepaid credit Card.

We have to pay an initial amount to do this also. For that we could use a Debit Card instead. I hope in today's world, Debit card is also being widely used, wherever credit card is applicable.

Obviously Prepaid credit cards should not bear interest,since the amnt used is ours, which is deposited in the bank. Based on that suerity we are able to obtain the cards.

Don\'t you think, this is just a trik played by the Bankers to populate credit cards in the market.

Sorry, there is usually an age minimum of 16 to get a prepaid card, just like a regular one. Although I have seen some that offer to teens as young as 13.

Just a tidbit: a prepaid credit card is the same thing as a "charge card" of yesteryear.

Hey i was wondering is there a age limit to this card like could a kid get one of these or no? if so what is the age limit?

I would like to use a prepaid credit card as a means of security. I am hoping that it can not be traced to other accounts as my regular cards can be. Would I still have the safety of purchase that is provided by my regular card. In other words if my card is stolen and used is my amount of responsibility still only up to $50.00?

You have to be very careful about credit card companies that "say" that they help re-establish credit. Most of them don't and it requires a federal action to become certified to do this. You also need to watch out for the free prepaid cards. Most of the time, they catch you on the loading, ATM and monthly fees. I purchased my Medallion Mastercard at [url] and have found it to be very good card. Good luck!

Eufora™ Preferred Credit Builder Prepaid Credit Card....that's the only one I have found so far that does report to a credit bureau. Hope this helps.

I actually have the same question - even though I have been living in the U.S. since 9 years I still have not been able to establish ANY credit.

I have a checking and savings account since day one and always pay my bills on time in full but whenever I have tried to apply for a credit card I was denied.

How long will it take about to establish credit through a prepaid credit card?

Does a prepaid credit card report activity to the credit bureau? I am trying to improve my credit and am told that having an open account with timely pymts is the way to go. However, I am having trouble applying for a card. Is prepaid an option for this?

Post your comments