At WiseGEEK, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

What are Payroll Stubs?

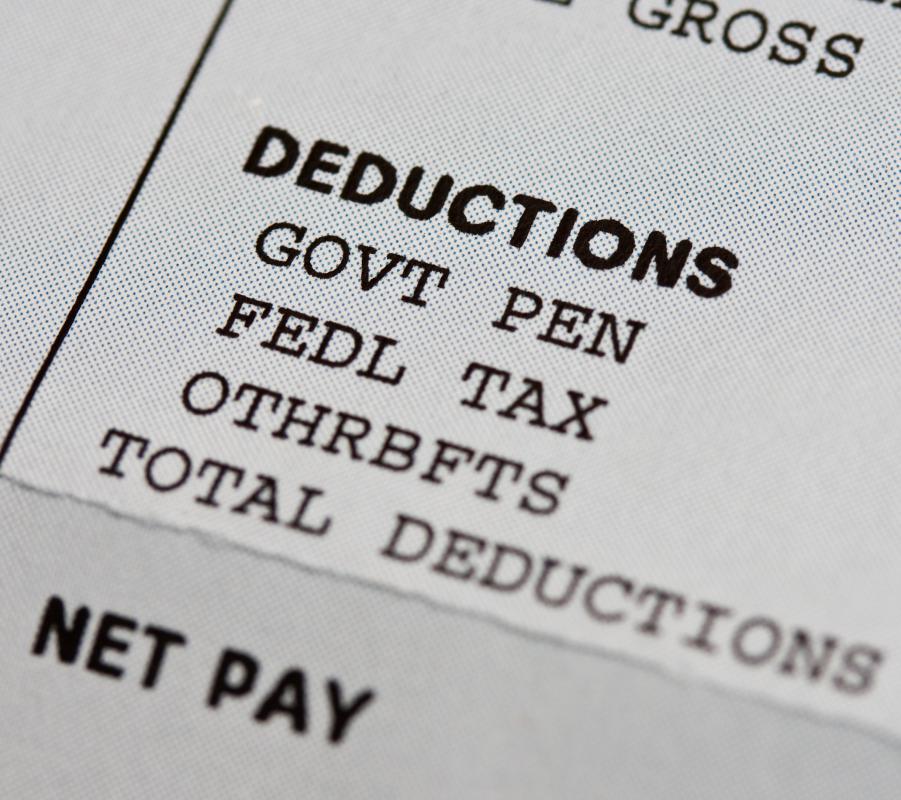

Payroll stubs typically come attached to a paycheck, summarizing the hours worked, rate of pay and any withholdings. They are useful for ensuring that the paycheck has been calculated correctly, and for tracking income and deductions. Though payroll stubs from each company may look different, they should have the same basic information. It should reflect exactly how much is withheld from the paycheck and why. Typical withholdings include payments of state and federal taxes, Medicare and Social Security payments (in the US), and contributions made to insurance plans or health savings accounts.

Payroll stubs may also report available sick time or vacation pay, which is valuable because it allows the employee to track available personal or sick time. They also typically contain a log of the amount of income year-to-date, and they may even state things like time worked at a company or hours worked within a year. A payroll stub will also report amount an employee contributes to a retirement plan, an employer's matching contributions, health savings account contributions, and deductions for insurance premiums.

Due to the fact that payroll stubs contain such important information about an employee's status, rate of pay, and deductions, there is often one question that people ask regarding them: how long should they be kept?

Under most circumstances, payroll stubs should be retained until one files yearly tax returns. While employers should give employees a final year end statement by the 31st of January, keeping payroll stubs is useful to compare the amounts for accuracy. Most experts recommend keeping tax records for seven years.

It’s important to make sure that payroll stubs are disposed of properly by shredding them, since they can easily be used to steal important personal information, including things like social security number and birth date.

AS FEATURED ON:

AS FEATURED ON:

Discussion Comments

my wife wants my check stub but won't tell me why. What could she want it for? She says she's going to some kind of appointment then asked for my stub. When i ask what's the appointment for or why she wants my stub, she says it's none of my business.

Post your comments