At WiseGEEK, we're committed to delivering accurate, trustworthy information. Our expert-authored content is rigorously fact-checked and sourced from credible authorities. Discover how we uphold the highest standards in providing you with reliable knowledge.

What are Payroll Deductions?

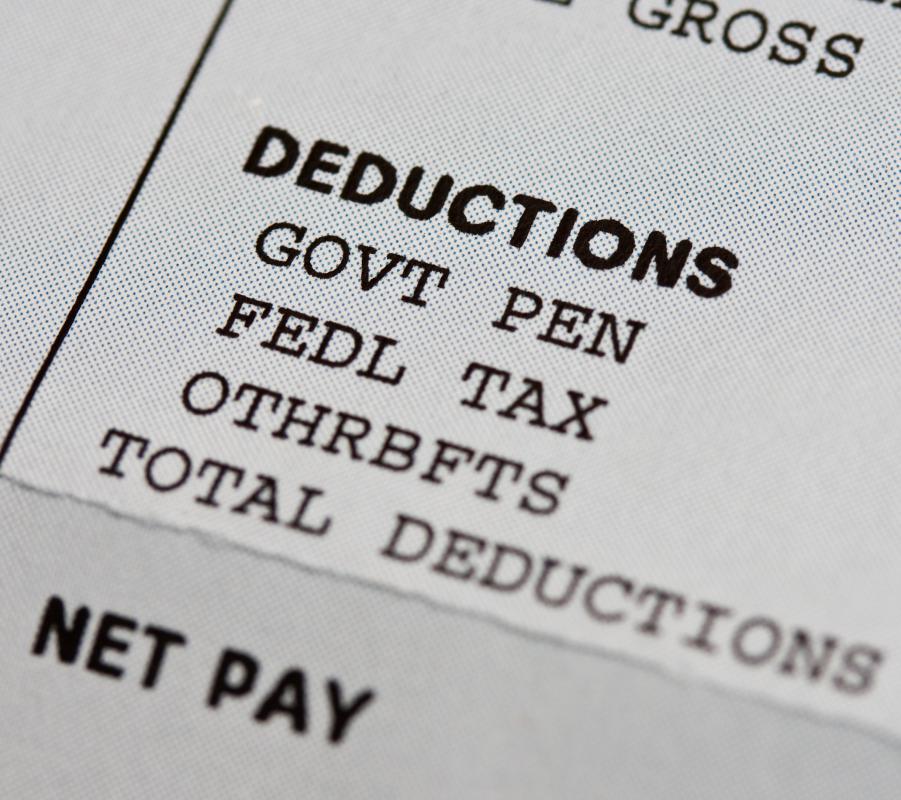

Payroll deductions are any amount of money that is withheld from an employee's check. Payroll deductions could be used to pay for health insurance, taxes, union dues, and flexible savings accounts. Payroll deductions are also used to fund retirement accounts.

With a payroll deduction, a certain amount of money will be taken out of an individual's paycheck before he or she receives it. Many times, the payroll deduction will occur before taxes are taken out. This lowers the amount of money that is taken home by the employee and helps pay for a variety of different things.

One of the most common reasons for a payroll deduction is to pay for health insurance. Many times, an employer will pay for full health insurance for an employee but will not pay for full insurance coverage for the employee's family. A payroll deduction can be used to pay for the remainder of the insurance coverage.

Another reason that payroll deductions are commonly used is to pay for taxes. As an employee, individuals have to pay for a number of different types of taxes. Part of the money will be used to pay for federal income taxes and another part will be used to pay for state income taxes.

In addition to income taxes, employees also have to pay Social Security taxes and Medicare. The employer pays half of both of these costs. The rest of the money is paid by using money from the employee's paycheck.

If the employee works in an industry in which unions are common, he or she might also have a certain amount of money deducted for union dues. This amount of money will go to the union of which he or she is a member. This money is used to help cover the administrative costs of running the union.

Another application of payroll deductions is in saving for tax-advantaged accounts. For example, individuals can use payroll deductions to fund flexible savings accounts and retirement accounts. Both of these accounts allow individuals to set aside money on a pretax basis from their paychecks. The amount of their contribution will be deducted from their gross pay before the taxes are calculated and withheld.

A flexible savings account allows an individual to save money for qualified medical expenses. A tax-advantaged retirement account, such as a 401k, allows employees to set aside a portion of their income toward saving for retirement. By using a payroll deduction, employees can make the process of saving for these expenses automatic.

AS FEATURED ON:

AS FEATURED ON:

Discuss this Article

Post your comments